Hill Creek Commercial Capital provides Texas Real-Estate Investors with short bridge loans nationwide and can close in 2 weeks. Financing commercial and some residential properties from loan amounts up to $50 Million

Purchases / Refinance / Construction / Heavy Rehab

-Fast Closing

-Lite Documentation

-Close in less than 2 weeks

-Up to $50 Million

Texas Commercial Hard Money Loan Terms

In as little as 10 days

Minimum Credit Score

None

Looking for quick, reliable financing for your Texas commercial real estate project? Our Texas Commercial Hard Money Lending solutions are designed to meet the needs of real estate investors, developers, and business owners across the state. Whether you’re investing in a new development, purchasing an existing commercial property, or need bridge financing, our hard money loans offer the flexibility and speed you need to close deals fast.

Quick Approval & Funding:

Get approved within 24 hours and receive funding in as little as 7 days. Our streamlined process ensures you can take advantage of investment opportunities without the usual delays associated with traditional lenders.

Flexible Loan Terms:

We offer customizable loan terms to fit your project’s specific needs. With options ranging from short-term bridge loans to longer-term financing, you can choose the terms that work best for your investment.

No Appraisal Required:

Skip the time-consuming appraisal process. We focus on the value of the property and your investment potential, allowing for faster approvals and fewer obstacles.

Competitive Interest Rates:

Benefit from competitive interest rates starting as low as 8.99%. Our rates are designed to keep your costs manageable while providing the capital you need.

Our Commercial Hard Money Loan Programs

Bridge Loans:

Perfect for transitioning between properties, our bridge loans provide temporary financing to cover the gap between buying a new property and selling an existing one.

Development & Construction Loans:

Ideal for ground-up construction projects, we offer loans that cover land acquisition, development costs, and construction expenses.

Commercial Property Loans:

Whether you’re investing in office buildings, retail spaces, warehouses, or multifamily properties, our commercial loans offer the capital you need to make it happen.

Refinancing:

Need to refinance an existing commercial property? We offer refinancing options that allow you to access equity, lower your interest rates, or extend your loan terms.

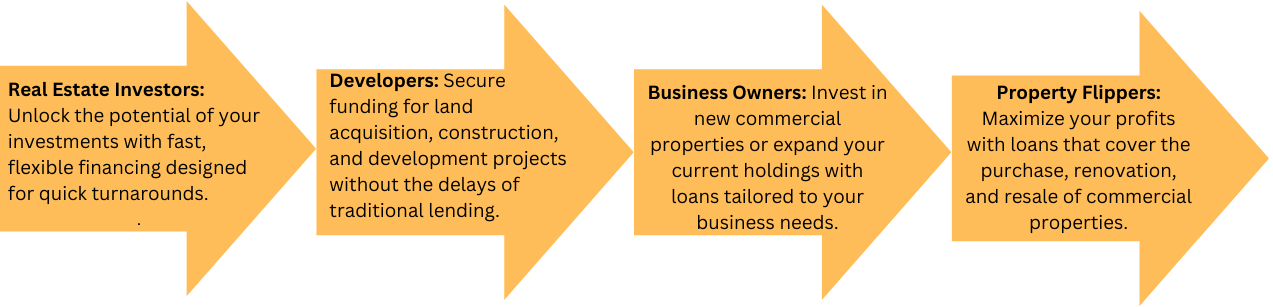

Who We Serve

Our Texas Commercial Hard Money Lending services cater to a wide range of real estate professionals, including:

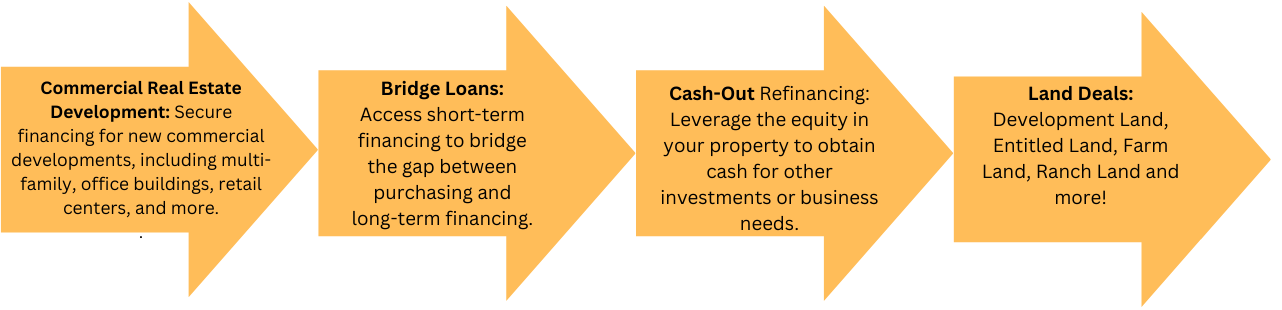

Types of Projects We Finance

A commercial hard money loan is a short-term financing solution secured by real estate. Unlike traditional loans, hard money lenders focus more on the property’s value than the borrower’s creditworthiness, making it an ideal solution for investors needing fast, flexible funding for commercial projects.

Traditional loans often have strict requirements such as high credit scores, lengthy approval processes, and extensive paperwork. On the other hand, hard money loans offer quicker approvals and focus primarily on the property’s value and project potential rather than the borrower’s financial history.

We finance a wide variety of commercial properties in Texas, including:

Interest rates for hard money loans are typically higher than traditional loans due to the shorter terms and increased flexibility. Rates can range from 10% to 13%, depending on the risk and scope of your project.

Loan terms typically range from 6 months to 36 months. However, we offer flexible options based on your project’s timeline and specific needs.

Our streamlined approval process allows us to approve loans in as little as 48 hours, with funding typically available within a week. This ensures you get the capital you need when you need it.

The down payment requirement varies depending on the property and the loan-to-value (LTV) ratio. Generally, borrowers should expect to provide 20-30% of the property’s value as a down payment.

Yes! Unlike traditional lenders, we prioritize the value and profitability of the property over the borrower’s credit score. As long as your project is viable and the property has sufficient equity, we can likely offer you financing.

Fees typically include origination fees (1-3%), appraisal fees, closing costs, and other loan processing fees. These will be outlined transparently at the beginning of the loan process.

A bridge loan is a type of hard money loan used to “bridge the gap” between a short-term financing need and more permanent financing. Hard money loans can serve a variety of purposes, including bridge financing, but not all hard money loans are bridge loans.

The loan-to-value ratio represents the loan amount as a percentage of the property’s appraised value. Most commercial hard money lenders offer loans with LTV ratios between 65% and 80%, meaning you can borrow up to 80% of the property’s value.

Yes, you can use a hard money loan to refinance existing commercial real estate loans, especially if you’re seeking a quicker, more flexible option or need additional capital for renovations or expansions.

While our documentation requirements are less stringent than traditional lenders, we typically ask for:

– Property details (address, type, value, etc.)

– Proof of ownership or purchase agreement

– Details of the project or intended use of funds

– Basic financial information (to assess loan repayment capacity)

Getting started is easy! Simply contact our team through the form on this page or call us at 713-331-9463. We’ll review your project and provide a tailored solution for your needs.

Hill Creek Commercial Capital

17350 State Highway 249 Ste 220 #2693, Houston, Texas 77064 Us

info@hillcreekcommercialcapital.com