Understanding Debt Yield in Commercial Real Estate Finance

Debt yield is a financial metric used in commercial real estate finance that measures the return a lender can expect on their investment if they need to foreclose on the property. It is calculated by dividing the property’s Net Operating Income (NOI) by the total loan amount. The formula is expressed as:

Importance of Debt Yield in Commercial Real Estate Finance

Debt yield is crucial in commercial real estate finance as it offers a standardized way to assess the profitability and Risk associated with a loan. Unlike other metrics, such as the Loan-to-Value (LTV) ratio and Debt Service Coverage Ratio (DSCR), debt yield is not influenced by market value fluctuations, interest rates, or amortization periods. This stability makes it a reliable indicator for lenders.

Overview of How Lenders Use Debt Yield to Assess Risk

Lenders use debt yield to determine the Risk of loaning money for a commercial property. A higher debt yield indicates a lower risk for the lender, as it suggests that the property’s income is sufficient to cover the loan amount in case of foreclosure. Many lenders set a minimum debt yield requirement to ensure they are making sound investment decisions. This metric helps lenders decide whether to approve a loan and at what terms, ultimately aiding in maintaining a balanced risk portfolio.

Calculation Formula: Debt Yield = Net Operating Income / Loan Amount

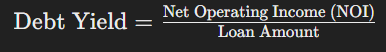

The debt yield ratio is calculated using a simple formula

This formula provides a clear and straightforward way to assess the financial health and risk of a commercial property loan.

In this example, the debt yield is 10%, indicating that the property generates income equal to 10% of the total loan amount. This ratio helps lenders evaluate whether the property’s income is sufficient to cover the loan amount and determine the risk level of the loan.

Significance of Debt Yield

Debt yield is a crucial metric in commercial real estate finance because it provides a stable and reliable risk assessment tool that remains consistent regardless of fluctuating market conditions. Unlike the Loan-to-Value (LTV) ratio, which can be influenced by changes in property market values, or the Debt Service Coverage Ratio (DSCR), which can be affected by varying interest rates and amortization periods, debt yield offers a straightforward and unchanging measure of Risk. This stability makes debt yield an essential tool for lenders when determining the potential return on investment if a borrower defaults on a loan. By calculating the debt yield, lenders can assess how long it would take to recoup their investment through property income alone.

Unlike other financial metrics, debt yield is simple and direct. The Loan-to-Value (LTV) ratio measures the loan amount against the appraised value of the property, which can fluctuate with market conditions, potentially leading to misleading risk assessments. On the other hand, the Debt Service Coverage Ratio (DSCR) evaluates the property’s ability to cover its debt obligations with its income. Still, changes can influence interest rates and loan amortization schedules. The Cap Rate, another commonly used metric, focuses on the return on investment based on the property’s current income and market value, which can be volatile.

Debt yield, however, is solely concerned with the relationship between the net operating income (NOI) and the loan amount, making it a more stable and dependable metric. This characteristic makes it particularly valuable for lenders who need a consistent and accurate measure of Risk, allowing them to set minimum debt yield requirements to ensure sound investment decisions. By using debt yield alongside metrics like LTV, DSCR, and Cap Rate, lenders can understand a commercial real estate loan’s financial health and risk profile.

How to Calculate Debt Yield

Detailed Steps for Calculation

Calculating debt yield is a straightforward process that involves a few key steps:

1. Determine the Net Operating Income (NOI): This is the annual income generated by the property after subtracting all operating expenses, excluding debt service and income taxes. Operating expenses include maintenance, property management fees, utilities, and property taxes.

2. Identify the Loan Amount: This is the total amount of the loan taken out to finance the property.

3. Apply the Debt Yield Formula: Divide the NOI by the loan amount to get the debt yield ratio. The formula is expressed as:

Tools and Calculators Available for Debt Yield Calculation

Several online tools and calculators can assist in calculating debt yield. These resources simplify the process and ensure accuracy, especially for more complex financial scenarios. Some recommended tools include:

Spreadsheet Templates: PropertyMetrics and other real estate education platforms provide spreadsheet templates for calculating debt yield, allowing easy adjustments and scenario analysis.

Financial Software: Software like Argus and other real estate investment analysis tools often include debt yield calculation features as part of their broader financial analysis capabilities.

Example Scenarios to Illustrate the Calculation Process

Here are a couple of example scenarios to demonstrate how to calculate debt yield:

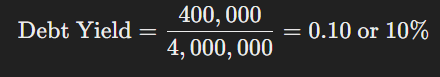

Scenario 1: A commercial property generates an annual NOI of $400,000. The total loan amount taken out for this property is $4,000,000. Using the debt yield formula:

In this scenario, the debt yield is 10%, indicating that the property generates an income that is 10% of the total loan amount.

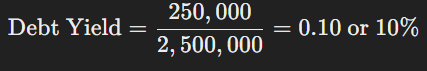

Scenario 2: Another property has an NOI of $250,000, and the loan amount is $2,500,000. The debt yield is calculated as follows:

Here, the debt yield is also 10%, suggesting that the property’s income is sufficient to cover 10% of the loan amount annually.

These examples highlight how debt yield provides a clear and consistent measure of commercial real estate loans’ financial health and risk. By following these steps and utilizing available tools, investors and lenders can accurately assess and compare the risk profiles of different properties.

Interpreting Debt Yield

What Constitutes a Good Debt Yield?

A good debt yield is typically 10% or higher. This benchmark indicates that the property generates sufficient income relative to the loan amount, providing a buffer for lenders in case of borrower default. A 10% or higher debt yield suggests that the property is a sound investment with a lower risk of financial distress.

How does debt yield vary according to property type and market conditions?

Debt yield can vary significantly depending on the property type and prevailing market conditions. For instance:

Property Type: Different property types have varying income potentials and risk profiles. For example, multifamily residential properties often have stable and predictable income streams, leading to lower required debt yields than more volatile property types like retail or hospitality.

Multifamily: Typically lower required debt yield due to stable cash flows.

Office Buildings: Moderate debt yield, influenced by lease agreements and occupancy rates.

Retail: Higher debt yield due to market volatility and changing consumer behavior.

Hospitality: Due to seasonal income variations and economic sensitivity, higher debt yield is required.

Market Conditions: Economic factors like interest rates, property values, and regional economic health can impact the acceptable debt yield.

Prime Markets: In prime markets with strong economic fundamentals and high demand, a lower debt yield (e.g., 8%) may be acceptable due to perceived lower Risk.

Secondary or Tertiary Markets: These markets require higher debt yields (e.g., 12%) to compensate for increased Risk and potential income volatility.

Minimum Acceptable Debt Yield in Different Scenarios

The minimum acceptable debt yield varies depending on the specific scenario and risk tolerance of the lender:

Prime Markets: Lenders might accept a debt yield as low as 8% in well-established, high-demand urban areas with robust economic conditions. These markets typically feature lower Risk due to strong tenant demand and stable income.

Secondary Markets: A debt yield of around 10% is generally expected in markets with moderate demand and economic activity. This balance accounts for moderate Risk while ensuring sufficient income relative to the loan amount.

High-Risk Properties or Markets: For properties in economically unstable regions or those with high vacancy rates and income volatility, lenders often require a higher debt yield, around 12% or more. This higher threshold provides a more significant margin of safety for lenders, reflecting the increased Risk of financial instability.

By understanding these variations and benchmarks, lenders and investors can better interpret debt yield and make informed decisions about commercial real estate investments’ financial health and risk profile.

Comparison with Other Financial Metrics

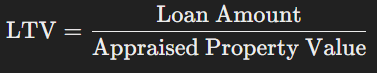

Debt Yield vs. Loan-to-Value Ratio

Explanation of LTV: The Loan-to-Value (LTV) ratio is a financial metric that compares the loan amount to the appraised property value. It is calculated as:

A lower LTV indicates that the property value is significantly higher than the loan amount, suggesting lower Risk for the lender.

Susceptibility of LTV to Market Value Fluctuations: LTV is heavily influenced by the property’s market value, which can fluctuate due to economic conditions, market trends, and property-specific factors. These fluctuations can result in an unstable risk assessment, as the property’s appraised value may change over time.

Why Debt Yield Provides a More Consistent Measure: Unlike LTV, debt yield is based on the property’s net operating income (NOI) relative to the loan amount, providing a stable measure of Risk unaffected by market value changes. This consistency makes debt yield more reliable for assessing a property’s financial health.

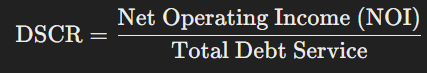

Debt Yield vs. Debt Service Coverage Ratio

Explanation of DSCR: The Debt Service Coverage Ratio (DSCR) measures the property’s ability to cover its debt obligations with its net operating income. It is calculated as:

A DSCR more significant than 1 indicates that the property generates enough income to cover its debt payments.

Impact of Interest Rates and Amortization Schedules on DSCR: DSCR can be influenced by changes in interest rates and the loan’s amortization schedule. Higher interest rates or shorter amortization periods can increase debt service payments, reducing the DSCR and potentially indicating higher Risk.

Stability of Debt Yield as a Measure: Debt yield is calculated solely based on NOI and loan amount, unaffected by interest rate changes or amortization schedules. This stability provides a clear and consistent risk assessment metric, regardless of external financial conditions.

Debt Yield vs. Cap Rate

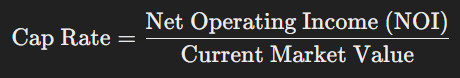

Explanation of Cap Rate: The Capitalization Rate (Cap Rate) is a metric used to assess the return on investment based on the property’s net operating income and current market value. It is calculated as:

A higher cap rate indicates a higher potential return on investment.

How Market Value Impacts Cap Rate: Like LTV, the cap rate is influenced by the property’s market value, which can fluctuate due to market conditions. Changes in property value can affect the cap rate, making it a less stable metric for long-term risk assessment.

Benefits of Using Debt Yield for Risk Assessment: Debt yield directly measures the property’s income relative to the loan amount, providing a stable and consistent risk assessment. It is not influenced by market value fluctuations, making it a reliable metric for lenders to evaluate a commercial property’s financial health and risk profile.

By comparing debt yield with LTV, DSCR, and Cap Rate, it becomes clear that debt yield offers a more consistent and stable measure of Risk, making it a valuable tool for lenders and investors in the commercial real estate sector.

Practical Applications in Real Estate Lending

How Lenders Use Debt Yield in Underwriting Loans

Lenders incorporate debt yield as a critical metric in the underwriting process to evaluate the Risk and viability of commercial real estate loans. During underwriting, lenders:

1. Assess Property Income: Lenders calculate the property’s Net Operating Income (NOI) to determine its ability to generate sufficient revenue to cover the loan amount.

2. Evaluate Loan Amount: The debt yield formula is applied to ascertain the relationship between NOI and the proposed loan amount.

3. Set Minimum Debt Yield Requirements: Lenders often establish minimum debt yield thresholds (typically around 10%) to ensure that the property generates adequate income relative to the loan, thereby minimizing Risk.

4. Compare with Other Metrics: Debt yield is used alongside other financial metrics, such as the Loan-to-Value (LTV) ratio and the Debt Service Coverage Ratio (DSCR), to provide a comprehensive risk assessment.

5. Adjust Loan Terms: If the debt yield is below the lender’s threshold, they may adjust loan terms, such as requiring additional equity, increasing interest rates, or reducing the loan amount to align with acceptable risk levels.

Case Studies of Debt Yield Application in Loan Approvals

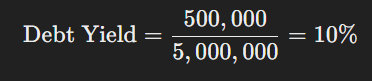

1. Multifamily Residential Property: A lender is evaluating a loan application for a multifamily residential property with an NOI of $500,000 and a loan request of $5,000,000. The calculated debt yield is:

The loan is approved with favorable terms since the debt yield meets the lender’s minimum requirement of 10%.

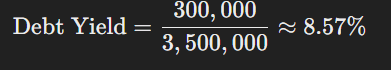

2. Retail Property in a Secondary Market: Another case involves a retail property with an NOI of $300,000 and a loan request of $3,500,000. The debt yield is:

The lender’s minimum debt yield requirement is 10%, so to achieve the target debt yield, the borrower might be required to inject more equity or reduce the loan amount to $3,000,000.

Role of Debt Yield in Commercial Mortgage-Backed Securities (CMBS)

Debt yield plays a significant role in securitizing commercial real estate loans into Commercial Mortgage-Backed Securities (CMBS). In the CMBS market:

1. Standardized Risk Assessment: Debt yield provides a uniform measure of Risk across different loans, facilitating the pooling and securitization process.

2. Investor Confidence: High debt yield ratios contribute to investor confidence by ensuring the underlying properties generate sufficient income to support the loan obligations, reducing default risk.

3. Tranching and Pricing: Debt yield influences the tranching and pricing of CMBS. Loans with higher debt yields are typically placed in higher-rated tranches with lower yields, while loans with lower debt yields might be placed in lower-rated tranches with higher yields to compensate for the increased Risk.

4. Ongoing Monitoring: Servicers and investors monitor the performance of the underlying loans in CMBS pools using debt yield. Consistent debt yield ratios indicate stable property performance, whereas declining debt yields might signal potential financial stress.

Through these practical applications, debt yield serves as an essential metric in both the direct lending and securitization processes, ensuring robust risk management and enhancing the stability of commercial real estate finance.

Benefits and Limitations of Debt Yield

Advantages of Using Debt Yield

1. Provides a Consistent Risk Measure: Debt yield offers a standardized metric based on the Net Operating Income (NOI) relative to the loan amount. This consistency allows lenders to reliably compare the income-generating potential of different properties without being influenced by subjective appraisals or fluctuating market values.

2. Insulated from Market Volatility: Unlike metrics that rely on market values, such as the Loan-to-Value (LTV) ratio or Cap Rate, debt yield is based solely on the NOI and the loan amount. This makes it less susceptible to market volatility and changes in property values, providing a stable measure of Risk over time.

3. Useful for Comparing Loans Across Different Properties: Debt yield is an effective tool for comparing various properties’ financial health and risk profiles, regardless of their type or location. By focusing on the income generated relative to the loan amount, lenders can assess which properties are more likely to generate sufficient revenue to cover their debt obligations.

Limitations and Considerations

1. Does Not Account for Future Income Projections: Debt yield is based on the current NOI, which may not reflect future changes in property income. Lease expirations, market rent adjustments, and property improvements can significantly impact future income. As such, relying solely on current NOI might overlook potential risks or opportunities.

2. Should Be Used in Conjunction with Other Metrics for a Comprehensive Risk Assessment: While debt yield provides valuable insights into the financial health of a property, it is not a standalone measure. To get a comprehensive understanding of a property’s risk profile, lenders should also consider other financial metrics, such as:

Loan-to-Value (LTV) Ratio: Provides insight into the equity cushion and the property’s market value.

Debt Service Coverage Ratio (DSCR) assesses the property’s ability to cover debt payments from its operating income.

Cap Rate: Indicates the return on investment based on the property’s current market value.

Future Cash Flow Projections: Evaluate potential changes in income and expenses over the loan term.

Using a combination of these metrics, lenders can develop a more thorough and nuanced risk assessment, ensuring that all relevant factors are considered when underwriting loans.

Conclusion

Recap of the Importance of Debt Yield in Commercial Real Estate Finance

Debt yield serves as a crucial metric in the realm of commercial real estate finance. It provides a standardized, consistent measure of Risk by evaluating the Net Operating Income (NOI) relative to the loan amount. This metric is less susceptible to market volatility than other financial metrics, making it a stable and reliable indicator of a property’s economic health. By focusing on the income-generating potential of a property, debt yield helps lenders make informed decisions, ensuring that loans are backed by properties with adequate income to support debt obligations.

Final Thoughts on Integrating Debt Yield into Loan Underwriting Processes

Integrating debt yield into the loan underwriting process is essential for effective risk management. Lenders can leverage this metric to assess the viability of loans, set appropriate loan terms, and ensure that properties have sufficient income to mitigate default risks. While debt yield provides significant insights, using it with other financial metrics such as the Loan-to-Value (LTV) ratio, Debt Service Coverage Ratio (DSCR), and future cash flow projections is essential. This comprehensive approach lets lenders capture a holistic view of a property’s risk profile, leading to more prudent lending decisions.

Encouragement for Investors and Lenders to Understand and Utilize Debt Yield for Better Risk Management

Understanding and utilizing debt yield is vital for investors and lenders aiming for robust commercial real estate finance risk management. By incorporating debt yield into their assessment toolkit, stakeholders can better understand a property’s financial stability and potential risks. This knowledge enables better decision-making, enhancing the overall health and resilience of loan portfolios. Investors and lenders are encouraged to familiarize themselves with debt yield calculations and interpretations, ensuring they are well-equipped to navigate the complexities of the commercial real estate market.

In summary, debt yield is a valuable metric that provides clarity and stability in risk assessment. Its integration into underwriting processes and other financial metrics fosters a comprehensive approach to evaluating commercial real estate investments. Embracing debt yield as a critical component of risk management strategies will lead to more secure and profitable outcomes in the commercial real estate sector.

Mortgage rates

| ||||||||||||||||||||||||||||||||||||

- 1031 Exchanges in Commercial Real Estate: Strategies, Benefits, and Challenges

- A Comprehensive Guide to Commercial Property Insurance

- About

- Achieving High Performance in Commercial Real Estate Operations

- Adaptive Strategies for Commercial Real Estate Success Amid Economic Uncertainty

- Amortization in Commercial Real Estate Lending

- Apartments

- Are Commercial Real Estate Loans Fixed or Variable?

- Bad Boy Carve-Outs in Commercial Real Estate Loans

- Beyond the Lease: Cultivating Enduring Tenant Relationships in Commercial Real Estate

- Blend and Extend Agreements: An Overview

- Blog

- Breakeven Occupancy

- bridge Loans

- Class A Offices: The Pinnacle of Commercial Real Estate

- Commercial Bridge Loans: A Strategic Guide for Real Estate Investors

- Commercial Development Finance: Key Strategies and Insights for Successful Property Projects

- Commercial Hard Money Bridge Loans

- Commercial Lease Escalation Clause

- Commercial Loan Defaults

- Commercial Lockout: Understanding Legalities and Procedures in Texas Real Estate

- Commercial Mortgage Calculator

- Commercial Mortgage-Backed Securities (CMBS) Loans

- Commercial Property Improvement Loan

- Commercial Property Management: A Comprehensive Guide

- Commercial Real Estate Appraisal: A Comprehensive Guide

- Commercial Real Estate Debt Funds: A Detailed Overview

- Commercial Real Estate Underwriting: Key Metrics, Processes, and Technological Integration

- Commercial Real Estate Valuation Models

- Commercial Real Estate: The Benefits of Long-term Investment

- Commercial Real-Estate Finance Brokers

- Commercial Zoning in Real Estate: A Comprehensive Guide

- Compound Interest Real Estate

- Conditional Use Real Estate: Permits, Compliance, and Development Opportunities

- Contact Us

- Defeasing in Commercial Real Estate: Benefits, Process, and Financial Flexibility

- Double Net Lease Explained: Benefits, Responsibilities, and Strategic Insights

- E-Commerce's Profound Impact on Commercial and Industrial Real Estate

- Emerging Technologies Impacting Commercial Real Estate

- Essential Steps for Successful Due Diligence in Commercial Property Investment

- Exit Strategies for Commercial Real Estate Investors

- Exploring Commercial Equity and Equity Participation Loans

- Exploring Commercial Real Estate Marketing Strategies

- Exploring Securitization in Commercial Real Estate: A Comprehensive Overview

- Exploring Submarkets in Real Estate: Identifying Opportunities and Achieving Growth

- Fixed Interest Rates: Stability, Benefits, and Strategic Financial Planning

- Florida Commercial Hard Money Loans

- Greening the Urban Jungle: The Rise of Sustainable Buildings in Commercial Real Estate

- Gross Potential Income (GPI) in Real Estate

- Hill Creek Commercial Capital

- Historic Tax Credits (HTC) in Real Estate Development

- Hospitality Loans: Flexible Financing for Hotel Acquisition, Renovation, and Expansion

- Hotel Loans

- Houston Commercial Hard Money Loans

- How Demographic Trends Shaping Commercial Real Estate

- How the Prime Rate Impacts Real Estate Loans and Investments in 2024

- Impact of Rising Interest Rates on Commercial Real Estate

- industrial

- Investing in Health: The Unyielding Appeal of Medical Office Real Estate

- Land Loans

- Land Use Restrictive Agreements (LURA): Ensuring Long-Term Affordable Housing Stability

- Launching Your Journey in Commercial Real Estate Investment: A Beginner's Blueprint

- Lease Assignment Explained: Key Steps, Benefits, and Potential Risks in Transferring Lease Rights

- Lease-Up Loans: Essential Financing for New Multifamily Properties

- Leveraging Opportunities in Distressed Commercial Real Estate

- Life Company Loans

- Liquidity in Commercial Real Estate Markets

- Loan Holdback

- Loan Quote

- Loan types

- Low-Income Housing Tax Credit

- Mastering Commercial Real Estate Development

- Mastering Credit Risk Analysis in Commercial Real Estate Lending

- Mastering Debt Constant: A Key Metric for Loan Assessment and Financial Decision-Making

- Mastering Real Estate Market Analysis: A Guide for Investors

- Mastering the Art of Commercial Lease Negotiation

- Mastering the Art of Refinancing Commercial Real Estate Loans

- Maximizing Profits In Commercial Real Estate Through Effective Leasing Strategies

- Maximizing Profits Through Strategic Real Estate Asset Management

- Maximizing Property Value with HUD Refinancing: Benefits, Eligibility, and Process

- Maximizing Rental Property Investment with SBA 504 Loans: Benefits and Eligibility Criteria

- Maximizing Returns in Real Estate: The Strategic Approach of CRE Multifamily in the Evolving Market

- Maximizing Returns: The Tax Advantages of Commercial Real Estate Investment

- Miami Commercial Hard Money Loans

- mortgage rates

- New York Commercial Hard Money Loans

- Office

- Office Real Estate Investment: Key Factors, Strategies, and Market Insights for Success

- Opportunity Zone Loans: Maximizing Tax Benefits and Investment Potential

- Optimizing Real Estate Investments: Key Structures and Strategies for Successful Partnerships

- Pari Passu in Real Estate: Ensuring Fair and Equitable Investment Strategies

- Permanant Financing

- Physical Vs. Economic Occupancy: A Comprehensive Analysis

- Portfolio Diversification with Commercial Real Estate

- Preparing for the Future: Commercial Real Estate and Climate Change

- Prepayment Penalties in Commercial Real Estate Financing

- Privacy Policy

- Promoted Structure in Commercial Real Estate: Aligning Interests and Maximizing Returns

- Real Estate Joint Ventures: Strategies, Structures, and Key Considerations

- Recourse and Non-Recourse Financing in Commercial Real Estate

- REITs vs. Direct Investment in Commercial Real Estate: Comparing investment vehicles and their implications

- Restaurant Financing: An Essential Guide for Culinary Ventures

- Retail

- Revitalizing Commercial Real Estate: A Guide to Enhancing Value in the Digital Era

- Revolutionizing the Secondary CRE Market: Unleashing Potential Amid Change

- Sale Leaseback Commercial Real Estate

- SBA 504

- SBA 7A

- Self-storage financing

- SOFR in Real Estate: Understanding the Transition from LIBOR and Its Industry Implications

- Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

- ssuming SBA Loans: Conditions, Benefits, and Risks Explained

- Texas Commercial Hard Money Loans

- The Complexities of Commercial Real Estate Syndication and Syndicated Loans

- the Due Diligence Process in Commercial Real Estate Investments

- The Regulatory Terrain: Mastering Real Estate Development and Investment in Today's World

- The Rise of Mixed-Use Developments in Urban Commercial Real Estate

- Thriving in Downturns: The Counterintuitive Appeal of Commercial Real Estate Investment During Recessions

- Transforming Spaces: The Evolution of Office Real Estate in a Post-COVID World

- Transforming Urban Landscapes through Commercial Real Estate Repurposing

- Understanding Anchor Tenants: Key Benefits and Strategies for Commercial Real Estate Success

- Understanding Base Year Stop in Commercial Leases: Benefits, Risks, and Cost Management

- Understanding BOMA Standards in Real Estate: Accurate Measurements and Enhanced Leasing Strategies

- Understanding CAM Charges in Commercial Real Estate

- Understanding Cap Rates in Commercial Real Estate Investment

- Understanding Commercial Loan Origination Fees in Real Estate

- Understanding Debt Service Coverage Ratio (DSCR) in Real Estate Investing

- Understanding Debt Yield in Commercial Real Estate Finance

- Understanding Fixed vs. Variable Interest Rates in Finance

- Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

- Understanding Ground Leases in Commercial Real Estate

- Understanding Load Factor in Real Estate: Impact on Leasing and Space Utilization

- Understanding Mezzanine Financing in Real Estate: Balancing Risk and Reward for Optimal Investment

- Understanding NPV in Real Estate: Calculating Profitability and Making Informed Investment Decisions

- Understanding Preferred Equity: Balancing Risk and Reward in Your Investment Portfolio

- Understanding Real Estate Limited Partnerships (RELPs): Benefits, Structure, and Investment Potentia

- Understanding Recapture Clauses in Commercial Leases: Benefits and Implementation Strategies

- Understanding Rent Ceilings: Balancing Affordability and Landlord Interests in Housing Policy

- Understanding the 2% Rule in Real Estate Investing: Maximizing Profitability and Cash Flow

- Unlocking Opportunities: A Deep Dive into Real Estate Crowdfunding Introduction

- Unlocking the Potential of Infill Real Estate: Strategies for Sustainable Urban Development

- Unlocking the Potential of Shadow Space: Strategies for Maximizing Real Estate Profitability

- Unveiling the Economic Titan: The Role of Commercial Real Estate

- We are negotiating Commercial Real Estate Deals: Techniques and tips for effective negotiation.

- What Is a Balloon Payment on a Commercial Loan

- What Is a Power Center in Real Estate?

- What Is Impact Investing in Commercial Real Estate

- Working from home May Adapt to Office Real Estate