In This Article

Commercial Lease Escalation Clause

An escalation clause in a commercial lease is a provision that allows for rent increases over the term of the lease, helping landlords cover rising operational costs. Common mechanisms include fixed bumps, percentage increases, and adjustments based on the Consumer Price Index (CPI). These clauses provide financial predictability for both parties but can be subject to negotiation, particularly concerning caps to protect against significant cost spikes. Variable CPI adjustments are often used to align rent with economic conditions, while tax pass-through increases shift rising property tax burdens to tenants.

Key Takeaways

- Escalation clauses in commercial leases provide rent increases to maintain financial viability.

- Common mechanisms include fixed bumps, percentage increases, and CPI-based adjustments.

- Negotiating rent increase caps can protect tenants from sudden cost spikes.

- Tax pass-through escalation shifts property tax increases to tenants, affecting financial forecasting.

- Fixed rent escalations offer predictability and help landlords manage operational costs.

Understanding Escalation Clauses

An escalation clause in a commercial lease allows landlords to periodically increase the rent to account for rising inflation and operating expenses. These clauses are essential for maintaining property management’s financial viability while providing tenants a structured understanding of future rent obligations. By outlining when and how rent increases will occur, escalation clauses offer predictability for both parties involved in the lease agreement.

Standard methods include fixed bumps, percentage increases, and CPI-based adjustments. Fixed bumps are predetermined increments in rent at specified intervals. Percentage increases involve raising the rent by a specific percentage, typically annually, to accommodate inflation and other cost fluctuations. CPI-based adjustments link rent increases to the Consumer Price Index (CPI), ensuring that rent adjustments reflect changes in the broader economic environment.

Negotiation plays a critical role in the formulation of escalation clauses. Tenants often seek to negotiate caps on rent increases to protect against significant spikes in occupancy costs. Such caps provide a safety net, allowing tenants to better predict their future financial obligations and effectively manage their financial planning.

Understanding the intricacies of escalation clauses is crucial for both landlords and tenants. Landlords must ensure they cover increasing operating expenses while maintaining attractive lease terms. Tenants must comprehend these clauses to budget accurately and avoid unforeseen financial strain. Thorough knowledge and careful negotiation of escalation clauses are fundamental for fostering a stable and mutually beneficial commercial leasing relationship.

Types of Rent Increases

Understanding the different types of rent increases in a commercial lease is essential for landlords and tenants to plan for future financial obligations effectively. Rent escalation clauses implement these increases and can significantly impact both parties’ budgeting and financial planning.

Direct Rent Increases involve either set or variable percentage increases. These can be predetermined or tied to indices such as the Consumer Price Index (CPI), offering predictability in commercial real estate leases. However, they may also introduce variability that requires careful financial planning.

Operating Cost Escalation links rent increases to specific expenses, such as standard area maintenance (CAM) and property taxes. This type of escalation can lead to rent fluctuations based on changes in operating costs, necessitating vigilant budgeting.

Tax Pass-Through Escalation obligates tenants to cover property tax increases beyond a base year. This type of escalation ensures rising property taxes do not burden landlords, but it can result in unexpected costs for tenants, making financial forecasting more complex.

Caps on Rent Increases protect tenants against sudden spikes in occupancy costs. These caps limit the amount by which rent can increase, providing a safeguard that enhances financial stability.

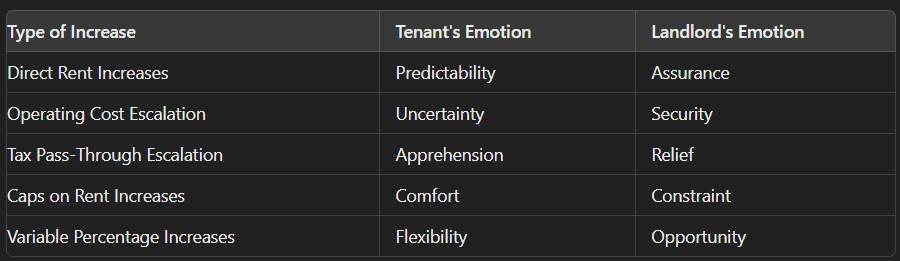

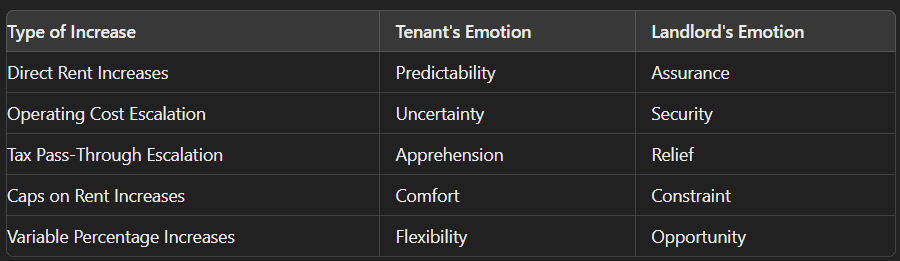

Different types of rent increases can evoke various emotional responses from tenants and landlords, as illustrated in the table below:

Understanding these rent increases and their implications is critical for effective financial planning in commercial real estate leases.

Fixed Rent Escalations

Fixed rent escalations in commercial leases entail predetermined, consistent increases in rent over specified intervals, offering landlords and tenants a clear framework for future financial commitments. This arrangement is particularly beneficial as it provides predictability and transparency, allowing both parties to plan their budgets effectively. Fixed rent escalations are widely used to account for inflation adjustments and rising property costs, guaranteeing that landlords can maintain their properties and cover necessary maintenance expenses.

In industrial leases, fixed rent escalations are expected to help landlords manage operational costs. These predetermined increases ensure landlords have a steady revenue stream to address the ongoing property upkeep and improvement expenses. For tenants, this means that rent spikes are avoided, creating a more stable financial environment and reducing the uncertainty that can come with variable rent adjustments.

However, tenants often negotiate caps on these fixed rent escalations to mitigate the risk of significant rent increases, which can impose budgeting limitations. Here are three key benefits of fixed rent escalations in commercial leases:

- Predictability: Landlords and tenants can foresee and plan for future rent payments, enhancing financial stability.

- Inflation Adjustment: Fixed increases help to accommodate inflation, ensuring the landlord’s revenue keeps pace with the rising cost of living and property management.

- Maintenance and Operational Costs: Regular, predictable rent increments assist landlords in covering ongoing maintenance and operational expenses, ensuring the property remains in good condition.

Variable CPI Adjustments

While fixed rent escalations offer predictability, variable CPI adjustments in commercial lease escalation clauses align rent increases with the Consumer Price Index, guaranteeing that changes reflect the current inflation rate. The Consumer Price Index (CPI) is a reliable economic indicator that tracks the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. By tying rent increases to the CPI, landlords and tenants can ensure that the rent remains fair and in line with the prevailing economic environment.

Variable CPI adjustments provide an objective method for determining rent increases, reducing potential disputes between landlords and tenants. These adjustments are inherently transparent, as government agencies publish the CPI regularly, offering a publicly accessible measure of inflation. This transparency fosters a sense of stability and confidence, which is essential for both parties in long-term commercial lease agreements.

Incorporating CPI adjustments into commercial lease escalation clauses allows rent to fluctuate by the actual inflation rate rather than being subject to arbitrary or fixed increases. This approach is particularly beneficial in periods of high inflation, as it protects landlords from losing purchasing power while safeguarding tenants from overpaying during low inflation.

Ultimately, variable CPI adjustments in commercial lease escalation clauses balance flexibility and fairness. By aligning rent increases with a recognized economic indicator, landlords and tenants can achieve a more equitable and stable leasing arrangement. This method ensures that rent adjustments are responsive to economic conditions and grounded in an objective, data-driven framework.

Tax Pass-Through Increases

Property tax pass-through increases in commercial leases enable landlords to transfer the burden of rising property taxes directly to their tenants. These increases are a significant component of operating cost escalations, allowing landlords to maintain profitability despite fluctuations in property tax rates. To guarantee fairness, landlords must accurately define the base year, the benchmark for calculating tax pass-through escalations. This base year establishes the initial property tax amount, with any subsequent increases being passed on to the tenants.

Property tax adjustments are an essential factor in determining occupancy costs for tenants. When structured effectively, these adjustments can lead to equitable cost allocations between landlords and tenants. Here are three critical points to take into account:

- Base Year Definition: Clearly defining the base year is crucial for accurate property tax adjustments, ensuring tenants are only responsible for increases beyond this initial period.

- Transparent Cost Allocation: Both parties should agree on the method of cost allocation to avoid disputes and ensure clarity in the lease agreement.

- Impact on Occupancy Costs: Property tax pass-through increases directly influence tenants’ overall occupancy costs, making it essential for tenants to understand potential future liabilities.

Lease Renewal Escalations

Understanding the potential for rent increases is essential for lease renewal escalations. Tenants should proactively negotiate escalation terms to secure more favorable conditions and mitigate the impact of rising costs. This negotiation can play a significant role in effective budgeting and long-term financial planning.

Renewal Rent Increases

Lease renewal escalations often increase rent, significantly impacting tenants’ long-term financial planning. When a lease term approaches its end, landlords may adjust the renewal rent to align with current market rates,

potentially triggering significant rent escalations. Tenants should be vigilant about the terms embedded within lease renewals to anticipate and manage these financial changes effectively.

Fixed-rate escalations can offer a more significant and manageable increase, providing tenants with a defined structure for future budgeting and financial planning. Understanding the nuances of lease renewal escalations is essential for tenants to avoid unexpected financial burdens. Here are three key points to take into account:

1. Current Market Rates: Landlords frequently adjust renewal rents to reflect the prevailing market conditions, which can lead to substantial increases.

2. Fixed Rate Escalations: Negotiating fixed rate escalations during lease renewals can help tenants maintain predictable rent increases, aiding in effective long-term budgeting.

3. Financial Planning: Tenants must incorporate potential rent escalations into their financial planning to ensure they can accommodate any increases without jeopardizing their financial stability.

Negotiating Escalation Terms

Thoughtful negotiation of escalation terms during lease renewals is essential for tenants to maintain manageable and predictable occupancy costs. When a commercial lease is up for renewal, landlords often take the opportunity to renegotiate rent terms, frequently including escalation clauses that can substantially impact future expenses. Hence, tenants must review lease renewal terms diligently to comprehend any proposed lease escalations.

Effective lease negotiations hinge on understanding the implications of escalation terms, which may involve annual rent increases or adjustments based on inflation indices. By carefully examining these terms, tenants can negotiate more favorable conditions that align with their financial planning and operational needs.

Engaging in professional advice during lease renewal negotiations can provide a strategic advantage. Real estate attorneys or experienced brokers can offer insights and negotiation tactics that ensure escalation clauses are fair and reflect current market conditions. This professional guidance can help tenants secure reasonable and predictable lease escalations, safeguarding their long-term occupancy costs.

Negotiating Fair Clauses

Crafting fair escalation clauses in commercial leases requires a strategic approach to balance the interests of both landlords and tenants. Negotiating these clauses effectively involves setting reasonable rent increase limits to guarantee that both parties experience predictability and stability throughout the lease term. Here are three essential considerations for negotiating fair escalation clauses:

1. Set Reasonable Rent Increase Limits: Establishing a fixed annual percentage increase is a common practice to ensure predictability in rent adjustments. This approach allows tenants to budget accordingly while providing landlords with a steady income stream. Collaborating with commercial real estate attorneys can help both parties determine what constitutes a reasonable increase based on market conditions and legal standards.

2. Consult with Commercial Real Estate Attorneys: Engaging experienced real estate attorneys is pivotal for understanding escalation clauses’ legal implications and considerations. These professionals can provide insights into industry norms and help draft fair and legally sound clauses. Their guidance ensures that the escalation terms are clear, enforceable, and protective of the tenant’s and landlord’s interests.

3. Incorporate Clear Language and Defined Terms: Ambiguity in escalation clauses can lead to disputes and misunderstandings. It is essential to include clear, concise language that outlines the specific conditions under which rent increases will occur. Defined terms help mitigate the risk of legal conflicts and provide both parties with a transparent agreement, fostering a positive landlord-tenant relationship.

Impacts on Tenants and Landlords

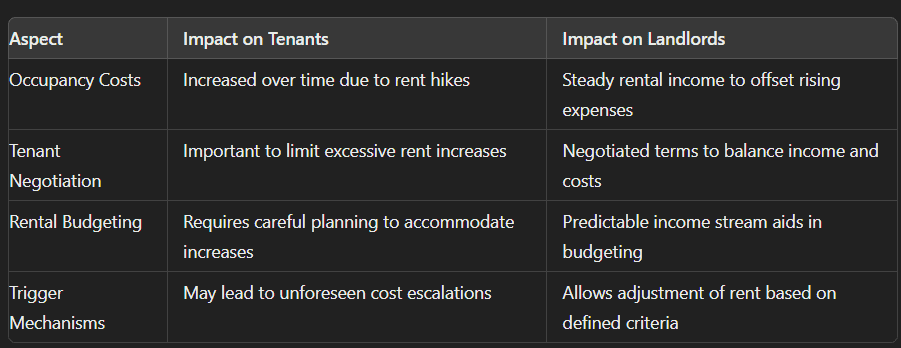

Understanding the impacts of commercial lease escalation clauses on tenants and landlords is critical to appreciate the broader implications of these agreements. Escalation clauses in commercial leases can significantly affect both parties, influencing various aspects of financial planning and operational strategies.

The primary impact for tenants lies in the potential increase in occupancy costs over the lease term. Rent increases, often tied to trigger mechanisms such as inflation or rising operating expenses, can strain a tenant’s budget. Consequently, tenant negotiation becomes important; tenants may seek to cap these increases to safeguard against excessive hikes. Being well-versed in the terms of an escalation clause is essential for effective rental budgeting.

Escalation clauses offer landlords a mechanism to adjust rental income in alignment with property expenses. This allows landlords to mitigate the financial risks associated with fluctuating operational costs and inflation, thus providing a stable income stream. Understanding the intricacies of these clauses is crucial for landlords to manage their properties efficiently and ensure that rental income keeps pace with rising property expenses.

To illustrate the impacts more clearly, consider the following table:

Frequently Asked Questions

What Are Escalations on a Commercial Lease?

Escalations in a commercial lease refer to provisions allowing rent increases over time. These adjustments account for rising utility costs, property taxes, maintenance fees, and everyday area expenses. Landlords may also implement percentage rent based on tenant sales and expense stops to limit liability. Expense caps protect tenants from excessive charges, while cost sharing for capital improvements guarantees equitable distribution of costs. Understanding these aspects is crucial for accurate budgeting and planning.

What Is an Escalation Clause in a Lease Agreement?

An escalation clause in a lease agreement permits a rent increase over time based on various conditions. These can include fixed increases, CPI adjustments, or changes in operating expenses. Typically, the base year is established to compare future costs. At lease renewal, rents may adjust to the market rate or through percentage rent. Additional components include expense stops and adjustments for utility costs, ensuring landlords recover rising expenses.

What Is the Biggest Potential Problem With an Escalation Clause?

The biggest potential problem with an escalation clause is sudden rent increases, which can create cost unpredictability for tenants. Market volatility may lead to significant rent hikes, causing financial strain and complicating budget planning. This undermines lease stability and hampers overhead control. Without caps, tenants face challenges in managing fixed expenses and negotiating favorable renewal terms, jeopardizing long-term tenant negotiations and financial planning.

Do Commercial Lease Escalation Clauses Typically Not Take Effect Until After What Period?

Typically, escalation clauses in commercial leases do not take effect until after the initial period, often one year from the lease commencement. During this base year, rent remains stable. Subsequent rent increases are triggered by escalation triggers such as operating expenses, inflation adjustments, or market rates. These adjustments, which may occur in fixed increments or as cost pass-throughs, guarantee landlords can cover rising costs while maintaining fair lease terms.

Conclusion

Understanding escalation clauses in commercial leases is vital for tenants and landlords. These clauses, which include fixed rent escalations, variable CPI adjustments, tax pass-through increases, and lease renewal escalations, have a substantial impact on the financial dynamics of a lease agreement. Negotiating fair and transparent terms can help prevent conflicts and guarantee a sustainable tenancy. Hence, carefully considering and negotiating these clauses are essential for maintaining equitable and economically viable lease arrangements.

Mortgage rates

| ||||||||||||||||||||||||||||||||||||

- 1031 Exchanges in Commercial Real Estate: Strategies, Benefits, and Challenges

- A Comprehensive Guide to Commercial Property Insurance

- About

- Achieving High Performance in Commercial Real Estate Operations

- Adaptive Strategies for Commercial Real Estate Success Amid Economic Uncertainty

- Amortization in Commercial Real Estate Lending

- Apartments

- Are Commercial Real Estate Loans Fixed or Variable?

- Bad Boy Carve-Outs in Commercial Real Estate Loans

- Beyond the Lease: Cultivating Enduring Tenant Relationships in Commercial Real Estate

- Blend and Extend Agreements: An Overview

- Blog

- Breakeven Occupancy

- bridge Loans

- Class A Offices: The Pinnacle of Commercial Real Estate

- Commercial Bridge Loans: A Strategic Guide for Real Estate Investors

- Commercial Development Finance: Key Strategies and Insights for Successful Property Projects

- Commercial Hard Money Bridge Loans

- Commercial Lease Escalation Clause

- Commercial Loan Defaults

- Commercial Lockout: Understanding Legalities and Procedures in Texas Real Estate

- Commercial Mortgage Calculator

- Commercial Mortgage-Backed Securities (CMBS) Loans

- Commercial Property Improvement Loan

- Commercial Property Management: A Comprehensive Guide

- Commercial Real Estate Appraisal: A Comprehensive Guide

- Commercial Real Estate Debt Funds: A Detailed Overview

- Commercial Real Estate Underwriting: Key Metrics, Processes, and Technological Integration

- Commercial Real Estate Valuation Models

- Commercial Real Estate: The Benefits of Long-term Investment

- Commercial Real-Estate Finance Brokers

- Commercial Zoning in Real Estate: A Comprehensive Guide

- Compound Interest Real Estate

- Conditional Use Real Estate: Permits, Compliance, and Development Opportunities

- Contact Us

- Defeasing in Commercial Real Estate: Benefits, Process, and Financial Flexibility

- Double Net Lease Explained: Benefits, Responsibilities, and Strategic Insights

- E-Commerce's Profound Impact on Commercial and Industrial Real Estate

- Emerging Technologies Impacting Commercial Real Estate

- Essential Steps for Successful Due Diligence in Commercial Property Investment

- Exit Strategies for Commercial Real Estate Investors

- Exploring Commercial Equity and Equity Participation Loans

- Exploring Commercial Real Estate Marketing Strategies

- Exploring Securitization in Commercial Real Estate: A Comprehensive Overview

- Exploring Submarkets in Real Estate: Identifying Opportunities and Achieving Growth

- Fixed Interest Rates: Stability, Benefits, and Strategic Financial Planning

- Florida Commercial Hard Money Loans

- Greening the Urban Jungle: The Rise of Sustainable Buildings in Commercial Real Estate

- Gross Potential Income (GPI) in Real Estate

- Hill Creek Commercial Capital

- Historic Tax Credits (HTC) in Real Estate Development

- Hospitality Loans: Flexible Financing for Hotel Acquisition, Renovation, and Expansion

- Hotel Loans

- Houston Commercial Hard Money Loans

- How Demographic Trends Shaping Commercial Real Estate

- How the Prime Rate Impacts Real Estate Loans and Investments in 2024

- Impact of Rising Interest Rates on Commercial Real Estate

- industrial

- Investing in Health: The Unyielding Appeal of Medical Office Real Estate

- Land Loans

- Land Use Restrictive Agreements (LURA): Ensuring Long-Term Affordable Housing Stability

- Launching Your Journey in Commercial Real Estate Investment: A Beginner's Blueprint

- Lease Assignment Explained: Key Steps, Benefits, and Potential Risks in Transferring Lease Rights

- Lease-Up Loans: Essential Financing for New Multifamily Properties

- Leveraging Opportunities in Distressed Commercial Real Estate

- Life Company Loans

- Liquidity in Commercial Real Estate Markets

- Loan Holdback

- Loan Quote

- Loan types

- Low-Income Housing Tax Credit

- Mastering Commercial Real Estate Development

- Mastering Credit Risk Analysis in Commercial Real Estate Lending

- Mastering Debt Constant: A Key Metric for Loan Assessment and Financial Decision-Making

- Mastering Real Estate Market Analysis: A Guide for Investors

- Mastering the Art of Commercial Lease Negotiation

- Mastering the Art of Refinancing Commercial Real Estate Loans

- Maximizing Profits In Commercial Real Estate Through Effective Leasing Strategies

- Maximizing Profits Through Strategic Real Estate Asset Management

- Maximizing Property Value with HUD Refinancing: Benefits, Eligibility, and Process

- Maximizing Rental Property Investment with SBA 504 Loans: Benefits and Eligibility Criteria

- Maximizing Returns in Real Estate: The Strategic Approach of CRE Multifamily in the Evolving Market

- Maximizing Returns: The Tax Advantages of Commercial Real Estate Investment

- Miami Commercial Hard Money Loans

- mortgage rates

- New York Commercial Hard Money Loans

- Office

- Office Real Estate Investment: Key Factors, Strategies, and Market Insights for Success

- Opportunity Zone Loans: Maximizing Tax Benefits and Investment Potential

- Optimizing Real Estate Investments: Key Structures and Strategies for Successful Partnerships

- Pari Passu in Real Estate: Ensuring Fair and Equitable Investment Strategies

- Permanant Financing

- Physical Vs. Economic Occupancy: A Comprehensive Analysis

- Portfolio Diversification with Commercial Real Estate

- Preparing for the Future: Commercial Real Estate and Climate Change

- Prepayment Penalties in Commercial Real Estate Financing

- Privacy Policy

- Promoted Structure in Commercial Real Estate: Aligning Interests and Maximizing Returns

- Real Estate Joint Ventures: Strategies, Structures, and Key Considerations

- Recourse and Non-Recourse Financing in Commercial Real Estate

- REITs vs. Direct Investment in Commercial Real Estate: Comparing investment vehicles and their implications

- Restaurant Financing: An Essential Guide for Culinary Ventures

- Retail

- Revitalizing Commercial Real Estate: A Guide to Enhancing Value in the Digital Era

- Revolutionizing the Secondary CRE Market: Unleashing Potential Amid Change

- Sale Leaseback Commercial Real Estate

- SBA 504

- SBA 7A

- Self-storage financing

- SOFR in Real Estate: Understanding the Transition from LIBOR and Its Industry Implications

- Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

- ssuming SBA Loans: Conditions, Benefits, and Risks Explained

- Texas Commercial Hard Money Loans

- The Complexities of Commercial Real Estate Syndication and Syndicated Loans

- the Due Diligence Process in Commercial Real Estate Investments

- The Regulatory Terrain: Mastering Real Estate Development and Investment in Today's World

- The Rise of Mixed-Use Developments in Urban Commercial Real Estate

- Thriving in Downturns: The Counterintuitive Appeal of Commercial Real Estate Investment During Recessions

- Transforming Spaces: The Evolution of Office Real Estate in a Post-COVID World

- Transforming Urban Landscapes through Commercial Real Estate Repurposing

- Understanding Anchor Tenants: Key Benefits and Strategies for Commercial Real Estate Success

- Understanding Base Year Stop in Commercial Leases: Benefits, Risks, and Cost Management

- Understanding BOMA Standards in Real Estate: Accurate Measurements and Enhanced Leasing Strategies

- Understanding CAM Charges in Commercial Real Estate

- Understanding Cap Rates in Commercial Real Estate Investment

- Understanding Commercial Loan Origination Fees in Real Estate

- Understanding Debt Service Coverage Ratio (DSCR) in Real Estate Investing

- Understanding Debt Yield in Commercial Real Estate Finance

- Understanding Fixed vs. Variable Interest Rates in Finance

- Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

- Understanding Ground Leases in Commercial Real Estate

- Understanding Load Factor in Real Estate: Impact on Leasing and Space Utilization

- Understanding Mezzanine Financing in Real Estate: Balancing Risk and Reward for Optimal Investment

- Understanding NPV in Real Estate: Calculating Profitability and Making Informed Investment Decisions

- Understanding Preferred Equity: Balancing Risk and Reward in Your Investment Portfolio

- Understanding Real Estate Limited Partnerships (RELPs): Benefits, Structure, and Investment Potentia

- Understanding Recapture Clauses in Commercial Leases: Benefits and Implementation Strategies

- Understanding Rent Ceilings: Balancing Affordability and Landlord Interests in Housing Policy

- Understanding the 2% Rule in Real Estate Investing: Maximizing Profitability and Cash Flow

- Unlocking Opportunities: A Deep Dive into Real Estate Crowdfunding Introduction

- Unlocking the Potential of Infill Real Estate: Strategies for Sustainable Urban Development

- Unlocking the Potential of Shadow Space: Strategies for Maximizing Real Estate Profitability

- Unveiling the Economic Titan: The Role of Commercial Real Estate

- We are negotiating Commercial Real Estate Deals: Techniques and tips for effective negotiation.

- What Is a Balloon Payment on a Commercial Loan

- What Is a Power Center in Real Estate?

- What Is Impact Investing in Commercial Real Estate

- Working from home May Adapt to Office Real Estate