In This Article

Commercial Lease Assignment: Steps, Benefits & Risks

Lease assignment is the legal transfer of lease obligations and rights from the original tenant to a new tenant. This process allows tenants to exit leases prematurely, usually requiring the Landlord’s formal consent via a License to Assign. The steps include obtaining landlord approval, vetting the new tenant, and finalizing legal documents. Common pitfalls involve paying attention to the new tenant’s financial viability and overlooking specific lease terms. While lease assignments offer financial relief, they also carry risks, such as the original tenant’s potential liability if the new tenant defaults. Understanding these nuances is crucial to guarantee a smooth handover and avoid legal issues.

Key Takeaways

- Lease assignment transfers lease obligations and rights from the original tenant to a new tenant.

- The Landlord’s formal consent through a ‘License to Assign’ is essential for lease assignment.

- All premises must be transferred during a lease assignment.

- The original tenant remains liable until the Landlord officially releases it.

- Proper vetting of the new tenant’s financial stability is crucial in lease assignments.

Definition and Importance

Lease assignment is the legal process through which a tenant transfers their lease obligations and rights to a new tenant. It provides an important exit strategy for tenants who must end their lease early. This process is precious in commercial settings where long-term lease agreements are standard, and unforeseen circumstances may require a tenant to leave early. The assignment enables the original tenant to pass on their lease commitments to a new tenant, easing financial or operational burdens.

The Landlord’s consent is crucial to the lease assignment process. This consent is formalized through a License to Assign document. The Landlord must provide reasonable approval, which involves evaluating the new tenant’s qualifications to ensure they can fulfill the lease obligations. Factors such as the new tenant’s financial stability, business reputation, and operational history typically influence the Landlord’s decision.

Once the lease assignment is approved, the new tenant and the Landlord establish a direct legal relationship. However, it is essential to note that the original tenant remains liable for the lease obligations unless explicitly released from them by the Landlord. This dual liability ensures that the Landlord maintains security if the new tenant defaults on the agreement.

In commercial contexts, lease assignments are a practical solution for tenants who must exit their lease agreements without incurring significant penalties. By enabling the transfer of lease rights and obligations, lease assignments provide a strategic exit mechanism that benefits all parties involved—original tenants, new tenants, and landlords.

Legal Requirements

Legal requirements for a lease assignment include obtaining the Landlord’s formal consent, often encapsulated in a License to Assign. This consent is vital, as it guarantees that both current and prospective new tenants adhere to the legal framework established by the original lease agreement. The Landlord’s consent is typically based on the new tenant’s qualifications and financial stability. This is especially important when the property involved is of significant value or is part of a commercial property.

The lease agreement may specify specific time frames within which the Landlord must review and approve the new tenant for the lease assignment. Please comply with these time frames to avoid legal complications or potential loss of the right to assign the lease. In addition, lease assignments typically involve transferring the entire premises to the new tenant rather than a sublease where only a portion of the property may be rented out.

The document formalizing the Landlord’s consent, often termed a ‘License to Assign,’ is a binding agreement among all parties involved. It outlines the terms under which the assignment is permissible and ensures that the new tenant assumes all responsibilities, including the payment of rent and adherence to property maintenance standards.

Some leases contain provisions allowing the Landlord to benefit from any profits from the assignment, making it a financially significant transaction for all parties. Consequently, current and prospective new tenants must meticulously review the lease agreement and any associated legal documents to ensure compliance and secure the necessary consent for a seamless lease transfer.

Steps Involved

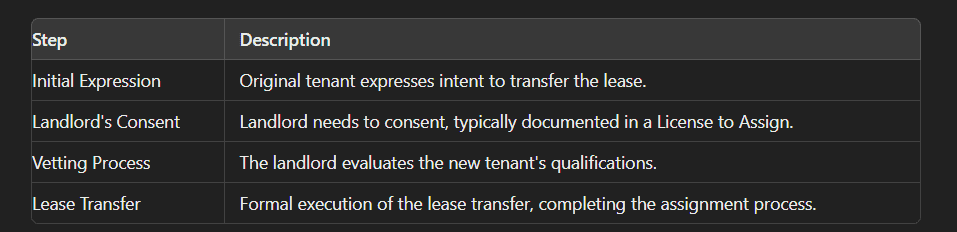

Initiating a lease assignment involves several methodical steps to guarantee a legally compliant and smooth tenancy handover. The process begins with the original tenant expressing the intent to transfer the lease to a new tenant. The next critical step is obtaining the Landlord’s consent. The Landlord must consent to the assignment based on the new tenant’s qualifications and financial stability.

A document called the ‘License to Assign’ is typically employed to formalize the Landlord’s consent. This document outlines the lease transfer’s terms and ensures that all parties are legally protected. Once the Landlord consents, the original and new tenants can assign the lease.

In the context of the lease assignment, it is essential to note that the original tenant is still responsible for any obligations under the lease until the Landlord formally releases them from this duty. This often involves a thorough vetting process where the Landlord evaluates the new tenant’s suitability to assume the lease.

The final step involves the execution of the lease transfer. This formalizes the new tenant’s rights and obligations under the lease, marking the completion of the lease assignment process. The lease is a title that holds significant legal weight, hence requiring meticulous attention to detail throughout the process.

Below is a summary table of the steps involved in a lease assignment:

Common Mistakes

Remember to thoroughly vet the financial stability and creditworthiness of the new tenant in lease assignments. Failing to do so can lead to significant economic risks for the original tenant, who may remain liable if the new tenant fails to meet lease obligations—ensuring that the new tenant is as financially sound as the existing one is pivotal for a successful lease assignment.

Another frequent error is being mindful that the leased property suits the new tenant’s business needs. This validation is critical as it directly impacts the new tenant’s ability to comply with the lease terms. A mismatch can lead to breaches and potential disputes, complicating the assignment process.

Additionally, complications often arise when the transfer of the entire premises is not executed correctly. Attempting to transfer only part of the premises can result in legal issues, as most lease agreements require the transfer of the entire leased property. Ensuring compliance with this condition is essential to avoid costly errors.

Landlord rights can also pose a significant challenge in lease assignments. Many leases contain clauses granting landlords a share of the profits from the assignment. Failing to recognize and adhere to these clauses can result in unexpected financial obligations and disputes.

It’s is essential to follow all lease terms and conditions accurately. Overlooking specific lease conditions or failing to obtain necessary approvals can lead to legal issues and the nullification of the assignment. Adhering meticulously to the lease terms ensures a smooth and legally compliant process.

Risks and Benefits

Recognizing the common mistakes and potential advantages of lease assignments is essential. A lease assignment involves the transfer of rights and responsibilities from the original tenant to a new tenant. This can be very helpful for tenants dealing with financial difficulties, as the new tenant will take over rent payments and other obligations, relieving the original tenant of these duties.

One of the primary benefits of a lease assignment is financial relief for the original tenant. The original tenant can avoid defaulting on rent payments and potentially damaging their credit by transferring the lease. Additionally, the new tenant takes on all obligations stipulated in the original lease, providing a clean break for the original tenant.

However, there are significant risks associated with lease assignments. One primary risk is that the original tenant may still be liable if the new tenant defaults. This residual liability can lead to financial complications and legal disputes. Landlords generally prefer creditworthy tenants to minimize these economic risks, making it essential for the original tenant to find a reliable replacement.

To mitigate these risks, tenants should negotiate a liability release with the Landlord during the lease agreement. Once the lease is successfully transferred, a liability release can absolve the original tenant from future obligations. This step is crucial to ensure a smooth handover and to protect the original tenant from potential financial repercussions.

Frequently Asked Questions

What Does Assign Lease Mean in NYC?

In New York City, “assigning a lease” refers to transferring a tenant’s responsibilities and rights to a new tenant. This transfer requires the Landlord’s permission and involves creating an agreement that outlines the legal implications. It can result in the original leaseholder’s lease being terminated while they may still be responsible for paying rent. Both the original leaseholder and the new tenant need to understand the rules for subletting and the leaseholder’s rights to ensure that everything is done in compliance with regulations.

What Does It Mean to Assign a Contract?

Assigning a contract involves transferring the rights and obligations from the original party (the “assignor”) to a new party (the “assignee”). This legal process typically requires the landlord’s consent and may involve fees for the assignment. The assignee takes on all the responsibilities and financial obligations of the original lease. Understanding the legal implications and ensuring compliance with the lease terms is crucial to facilitating a smooth transition to the new tenant.

What Is Assignment and Assumption of Lease in California?

In California, assignment and lease assumption involves transferring tenant responsibilities to a new party. This requires landlord approval and an assignment notice. Legal considerations include ensuring the new tenant adheres to the original lease duration and rent obligations. The assignor may still retain some liability unless released. Unlike a sublease agreement, this process may affect security deposits and lead to lease termination if improperly managed.

Conclusion

Lease assignments involve transferring lease obligations and rights from one party to another, it necessitates a thorough understanding of legal requirements and systematic execution of steps. Avoiding common mistakes is essential to mitigate potential risks and leverage the benefits of lease assignments. A detailed grasp of the process guarantees compliance and maximizes advantages, emphasizing the importance of meticulous attention to detail and adherence to legal standards in successful lease assignment execution.

Mortgage rates

| ||||||||||||||||||||||||||||||||||||

- 1031 Exchanges in Commercial Real Estate: Strategies, Benefits, and Challenges

- A Comprehensive Guide to Commercial Property Insurance

- About

- Achieving High Performance in Commercial Real Estate Operations

- Adaptive Strategies for Commercial Real Estate Success Amid Economic Uncertainty

- Amortization in Commercial Real Estate Lending

- Apartments

- Are Commercial Real Estate Loans Fixed or Variable?

- Bad Boy Carve-Outs in Commercial Real Estate Loans

- Beyond the Lease: Cultivating Enduring Tenant Relationships in Commercial Real Estate

- Blend and Extend Agreements: An Overview

- Blog

- Breakeven Occupancy

- bridge Loans

- Class A Offices: The Pinnacle of Commercial Real Estate

- Commercial Bridge Loans: A Strategic Guide for Real Estate Investors

- Commercial Development Finance: Key Strategies and Insights for Successful Property Projects

- Commercial Hard Money Bridge Loans

- Commercial Lease Escalation Clause

- Commercial Loan Defaults

- Commercial Lockout: Understanding Legalities and Procedures in Texas Real Estate

- Commercial Mortgage Calculator

- Commercial Mortgage-Backed Securities (CMBS) Loans

- Commercial Property Improvement Loan

- Commercial Property Management: A Comprehensive Guide

- Commercial Real Estate Appraisal: A Comprehensive Guide

- Commercial Real Estate Debt Funds: A Detailed Overview

- Commercial Real Estate Underwriting: Key Metrics, Processes, and Technological Integration

- Commercial Real Estate Valuation Models

- Commercial Real Estate: The Benefits of Long-term Investment

- Commercial Real-Estate Finance Brokers

- Commercial Zoning in Real Estate: A Comprehensive Guide

- Compound Interest Real Estate

- Conditional Use Real Estate: Permits, Compliance, and Development Opportunities

- Contact Us

- Defeasing in Commercial Real Estate: Benefits, Process, and Financial Flexibility

- Double Net Lease Explained: Benefits, Responsibilities, and Strategic Insights

- E-Commerce's Profound Impact on Commercial and Industrial Real Estate

- Emerging Technologies Impacting Commercial Real Estate

- Essential Steps for Successful Due Diligence in Commercial Property Investment

- Exit Strategies for Commercial Real Estate Investors

- Exploring Commercial Equity and Equity Participation Loans

- Exploring Commercial Real Estate Marketing Strategies

- Exploring Securitization in Commercial Real Estate: A Comprehensive Overview

- Exploring Submarkets in Real Estate: Identifying Opportunities and Achieving Growth

- Fixed Interest Rates: Stability, Benefits, and Strategic Financial Planning

- Florida Commercial Hard Money Loans

- Greening the Urban Jungle: The Rise of Sustainable Buildings in Commercial Real Estate

- Gross Potential Income (GPI) in Real Estate

- Hill Creek Commercial Capital

- Historic Tax Credits (HTC) in Real Estate Development

- Hospitality Loans: Flexible Financing for Hotel Acquisition, Renovation, and Expansion

- Hotel Loans

- Houston Commercial Hard Money Loans

- How Demographic Trends Shaping Commercial Real Estate

- How the Prime Rate Impacts Real Estate Loans and Investments in 2024

- Impact of Rising Interest Rates on Commercial Real Estate

- industrial

- Investing in Health: The Unyielding Appeal of Medical Office Real Estate

- Land Loans

- Land Use Restrictive Agreements (LURA): Ensuring Long-Term Affordable Housing Stability

- Launching Your Journey in Commercial Real Estate Investment: A Beginner's Blueprint

- Lease Assignment Explained: Key Steps, Benefits, and Potential Risks in Transferring Lease Rights

- Lease-Up Loans: Essential Financing for New Multifamily Properties

- Leveraging Opportunities in Distressed Commercial Real Estate

- Life Company Loans

- Liquidity in Commercial Real Estate Markets

- Loan Holdback

- Loan Quote

- Loan types

- Low-Income Housing Tax Credit

- Mastering Commercial Real Estate Development

- Mastering Credit Risk Analysis in Commercial Real Estate Lending

- Mastering Debt Constant: A Key Metric for Loan Assessment and Financial Decision-Making

- Mastering Real Estate Market Analysis: A Guide for Investors

- Mastering the Art of Commercial Lease Negotiation

- Mastering the Art of Refinancing Commercial Real Estate Loans

- Maximizing Profits In Commercial Real Estate Through Effective Leasing Strategies

- Maximizing Profits Through Strategic Real Estate Asset Management

- Maximizing Property Value with HUD Refinancing: Benefits, Eligibility, and Process

- Maximizing Rental Property Investment with SBA 504 Loans: Benefits and Eligibility Criteria

- Maximizing Returns in Real Estate: The Strategic Approach of CRE Multifamily in the Evolving Market

- Maximizing Returns: The Tax Advantages of Commercial Real Estate Investment

- Miami Commercial Hard Money Loans

- mortgage rates

- New York Commercial Hard Money Loans

- Office

- Office Real Estate Investment: Key Factors, Strategies, and Market Insights for Success

- Opportunity Zone Loans: Maximizing Tax Benefits and Investment Potential

- Optimizing Real Estate Investments: Key Structures and Strategies for Successful Partnerships

- Pari Passu in Real Estate: Ensuring Fair and Equitable Investment Strategies

- Permanant Financing

- Physical Vs. Economic Occupancy: A Comprehensive Analysis

- Portfolio Diversification with Commercial Real Estate

- Preparing for the Future: Commercial Real Estate and Climate Change

- Prepayment Penalties in Commercial Real Estate Financing

- Privacy Policy

- Promoted Structure in Commercial Real Estate: Aligning Interests and Maximizing Returns

- Real Estate Joint Ventures: Strategies, Structures, and Key Considerations

- Recourse and Non-Recourse Financing in Commercial Real Estate

- REITs vs. Direct Investment in Commercial Real Estate: Comparing investment vehicles and their implications

- Restaurant Financing: An Essential Guide for Culinary Ventures

- Retail

- Revitalizing Commercial Real Estate: A Guide to Enhancing Value in the Digital Era

- Revolutionizing the Secondary CRE Market: Unleashing Potential Amid Change

- Sale Leaseback Commercial Real Estate

- SBA 504

- SBA 7A

- Self-storage financing

- SOFR in Real Estate: Understanding the Transition from LIBOR and Its Industry Implications

- Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

- ssuming SBA Loans: Conditions, Benefits, and Risks Explained

- Texas Commercial Hard Money Loans

- The Complexities of Commercial Real Estate Syndication and Syndicated Loans

- the Due Diligence Process in Commercial Real Estate Investments

- The Regulatory Terrain: Mastering Real Estate Development and Investment in Today's World

- The Rise of Mixed-Use Developments in Urban Commercial Real Estate

- Thriving in Downturns: The Counterintuitive Appeal of Commercial Real Estate Investment During Recessions

- Transforming Spaces: The Evolution of Office Real Estate in a Post-COVID World

- Transforming Urban Landscapes through Commercial Real Estate Repurposing

- Understanding Anchor Tenants: Key Benefits and Strategies for Commercial Real Estate Success

- Understanding Base Year Stop in Commercial Leases: Benefits, Risks, and Cost Management

- Understanding BOMA Standards in Real Estate: Accurate Measurements and Enhanced Leasing Strategies

- Understanding CAM Charges in Commercial Real Estate

- Understanding Cap Rates in Commercial Real Estate Investment

- Understanding Commercial Loan Origination Fees in Real Estate

- Understanding Debt Service Coverage Ratio (DSCR) in Real Estate Investing

- Understanding Debt Yield in Commercial Real Estate Finance

- Understanding Fixed vs. Variable Interest Rates in Finance

- Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

- Understanding Ground Leases in Commercial Real Estate

- Understanding Load Factor in Real Estate: Impact on Leasing and Space Utilization

- Understanding Mezzanine Financing in Real Estate: Balancing Risk and Reward for Optimal Investment

- Understanding NPV in Real Estate: Calculating Profitability and Making Informed Investment Decisions

- Understanding Preferred Equity: Balancing Risk and Reward in Your Investment Portfolio

- Understanding Real Estate Limited Partnerships (RELPs): Benefits, Structure, and Investment Potentia

- Understanding Recapture Clauses in Commercial Leases: Benefits and Implementation Strategies

- Understanding Rent Ceilings: Balancing Affordability and Landlord Interests in Housing Policy

- Understanding the 2% Rule in Real Estate Investing: Maximizing Profitability and Cash Flow

- Unlocking Opportunities: A Deep Dive into Real Estate Crowdfunding Introduction

- Unlocking the Potential of Infill Real Estate: Strategies for Sustainable Urban Development

- Unlocking the Potential of Shadow Space: Strategies for Maximizing Real Estate Profitability

- Unveiling the Economic Titan: The Role of Commercial Real Estate

- We are negotiating Commercial Real Estate Deals: Techniques and tips for effective negotiation.

- What Is a Balloon Payment on a Commercial Loan

- What Is a Power Center in Real Estate?

- What Is Impact Investing in Commercial Real Estate

- Working from home May Adapt to Office Real Estate