In This Article

Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

A Sources and Uses table is crucial in real estate transactions, outlining the origin and allocation of capital to ensure that available funds align with required funds. Typical sources of financing include bank loans, private lenders, equity contributions, and project income. Uses of funds encompass purchase costs, construction expenses, debt service, and operating expenses. This detailed financial planning enhances transparency, mitigates risks, and guarantees efficient fund allocation. Understanding these elements is essential for maximizing returns and maintaining robust financial health in real estate investments.

Key Takeaways

- Sources and Uses tables outline the origin and allocation of capital in real estate transactions, ensuring financial transparency.

- Familiar sources of funds include bank loans, private lenders, equity contributions, and project income.

- The primary uses of funds are acquisition costs, development and renovation expenses, refinancing, and working capital.

- Sources and Uses tables help identify potential risks and ensure efficient allocation of funds for financial feasibility.

- Market fluctuations and legal compliance issues can impact the effectiveness of Sources and Use planning in real estate.

Understanding Sources and Uses

The Sources and Uses table is an essential financial tool that outlines the origin and allocation of capital in real estate transactions. As a detailed breakdown, this table ensures that the total amount of funds available aligns precisely with the total amount required for a project. It plays an integral role in real estate financial planning, offering a transparent view of the capital stack and its application toward different facets of a transaction.

In real estate, the Sources and Uses table captures both the sources of funds and their specific uses. The sources of capital can be varied, including loans, equity contributions, project income, joint ventures, and sale-leaseback transactions. This diversity in funding sources helps structure a robust capital stack, which is critical for successfully executing real estate projects. The capital stack is the hierarchy of all the financial sources used in a deal, each with its level of risk and return.

On the expenditure side, the table meticulously details how these funds are allocated. The funds’ uses typically encompass the property’s purchase price, construction costs, debt service, and operating expenses. By clearly delineating the uses, the table aids in ensuring that all financial requirements of the project are met without any shortfalls. This meticulous allocation is crucial for maintaining financial solvency and effective risk management.

Common Sources of Financing

When considering familiar sources of real estate financing, bank loans and private lender options stand out due to their distinct advantages. Banks are known for offering competitive interest rates, making them a popular choice for many borrowers. Conversely, private lenders, including debt funds, provide more flexible terms and cater to unique financing needs that may not fit traditional criteria.

Bank Loans Overview

Bank loans offer real estate investors competitive rates and terms, making them a reliable choice for acquisitions and developments. In commercial real estate, banks stand out as a predominant source of funds. Their established lending practices and robust financial backing give borrowers confidence and security. These loans can be employed for various uses of funds, including purchasing properties, constructing new developments, and refinancing existing debt.

Understanding the sources of funds and their corresponding uses is essential for managing project costs effectively. Bank loans, often secured by collateral, offer structured repayment schedules that align with the projected cash flows of the real estate venture. This alignment ensures that the financing arrangement is sustainable over the long term. Banks typically provide various loan products tailored to project needs, from short-term construction loans to long-term mortgages.

Borrowers must meet specific criteria to secure bank loans, such as demonstrating creditworthiness and providing detailed project plans. These requirements, while stringent, guarantee that both parties—the lender and the borrower—are protected, fostering a stable and efficient financial ecosystem for real estate investments.

Private Lender Options

Private lender options, including hard money lenders, private equity firms, and private debt funds, provide real estate investors with flexible and reasonable financing alternatives. Unlike traditional banks, these private lenders offer faster approvals and customized financing solutions, making them an attractive source of capital for various real estate ventures. Their asset-based lending approach suits investors undertaking unique or non-traditional projects, such as fix-and-flip properties, ground-up developments, and distressed property acquisitions.

One key advantage of private lender financing is the ability to access funds quickly and with fewer stringent requirements. This can significantly enhance cash flow management for investors who must act swiftly in competitive markets. However, this convenience comes at a cost. Borrowers often face higher interest rates and fees, which can elevate the overall use of funds. Additionally, closing costs may be higher compared to traditional financing methods.

Despite the higher costs, the flexibility and speed offered by private lenders can be invaluable. They allow investors to seize opportunities that may otherwise be missed due to conventional banks’ lengthy approval processes, thereby maximizing potential returns on investment.

Key Uses of Financing

Understanding the critical uses of financing in real estate is essential for balancing risk and return, matching investment horizons, and evaluating the impact of leverage on cash flow. Real estate financing is pivotal in structuring deals and guaranteeing that projects are viable and profitable. Here are the primary uses of funding in real estate:

1. Acquisition Costs: The initial expenditure required to purchase property is a significant part of any real estate transaction. This includes the purchase price and related expenses such as closing costs, broker fees, and due diligence costs. Proper financing guarantees these costs are covered without straining cash flows.

2. Development and Renovation: Financing is often used to develop or renovate new properties. This can include construction, materials, labor, and permitting expenses. Ensuring a stable source of funds for these activities is critical for maintaining project timelines and quality.

3. Refinancing: Property owners may refinance existing loans to benefit from better interest rates or more favorable loan terms. Refinancing can also be a strategic move to restructure the capital structure, optimize the overall cost of capital, and enhance cash flow management.

4. Working Capital: Adequate working capital is necessary for a property’s day-to-day operations and maintenance. It can cover various expenses, including property management fees, repairs, utilities, and other operational costs. Guaranteeing a steady flow of funds for these activities helps maintain the property’s value and performance.

Benefits of Sources and Uses

A thorough Sources and Uses analysis offers numerous benefits, including enhanced transparency and financial accountability in commercial real estate transactions. By providing a detailed overview of fund sources and capital allocation, this analysis guarantees that all stakeholders are well-informed about the financial commitments and loan terms involved. This transparency is essential for maintaining trust and clarity among investors, developers, and financial institutions.

The detailed breakdown of Sources and Uses helps identify potential risk areas, allowing for effective risk mitigation strategies. This proactive approach minimizes uncertainties and enhances the overall stability of the transaction. Additionally, the analysis supports a thorough financial assessment by detailing the allocation of funds for acquisition costs and project business models, ensuring that the capital is utilized efficiently and effectively.

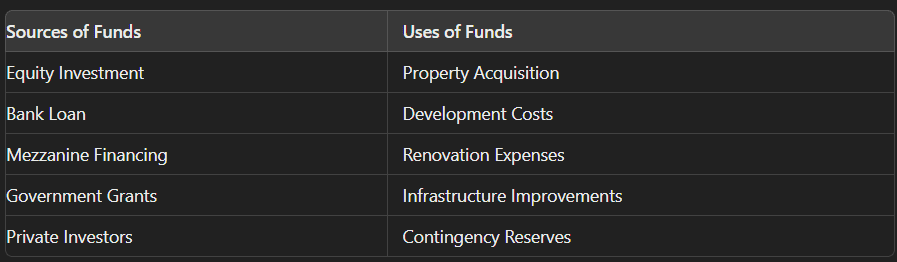

One of the key advantages of a Sources and Uses table is that it ensures the sources of funds match the intended uses. This alignment maintains financial feasibility and transparency, preventing any shortfalls or misallocations of capital. Below is an example of how such a table might look:

Risks to Consider

When evaluating real estate investments, it is essential to consider the impact of market fluctuations on property values and demand, which can significantly influence returns. Additionally, ensuring legal compliance is critical to mitigate risks related to zoning laws, building codes, and other regulatory requirements. Addressing these factors is essential for sustainable and profitable real estate ventures.

Market Fluctuation Impact

Market fluctuations present significant risks to property values, rental income, and financing terms in real estate. Understanding these risks is essential for maintaining investor confidence and effectively maneuvering the real estate market. Fluctuations can result from various factors, including changes in interest rates, economic downturns, and shifts in supply and demand.

Here are four key risks associated with market fluctuations:

1. Interest Rate Changes: Rising interest rates can increase borrowing costs, reduce the affordability of property purchases, and impact financing terms.

2. Economic Downturns: Economic recessions can decrease demand for real estate, lowering property values and rental income.

3. Supply and Demand Shifts: Overbuilding or changes in population dynamics can alter market supply and demand, affecting property prices and vacancy rates.

4. Market Volatility: Unpredictable market dynamics can erode investor confidence, stalling property sales and development projects.

Mitigating these risks involves understanding market dynamics and employing strategies such as diversification and long-term investment horizons. By staying informed and agile, investors can better anticipate and respond to market fluctuations, safeguarding their investments and maximizing returns in the ever-changing real estate landscape.

Legal Compliance Issues

In addition to market fluctuations, legal compliance issues present another critical risk factor in real estate transactions, requiring thorough due diligence and adherence to various regulations. Legal compliance encompasses several areas, including zoning laws, building codes, environmental regulations, tax laws, and land use restrictions. Failure to comply with these regulations can result in substantial fines, project delays, or cancellations, notably impacting cash flow and a real estate project’s overall financial viability.

Real estate investors, developers, and lenders must allocate adequate funds to cover the costs associated with legal compliance. This includes hiring legal experts to navigate the complex regulatory landscape and ensure that all aspects of the project meet local, state, and federal requirements. Additionally, maintaining an interest reserve can be wise, as it provides a financial cushion to cover interest payments during regulatory delays or unforeseen legal challenges.

Given the variability of legal compliance issues by location and property type, tailored legal guidance is essential. Thorough due diligence and proactive risk management are necessary to mitigate these risks, safeguard the long-term success of real estate transactions, and avoid potentially costly legal disputes.

Enhancing Returns With S&U

Aligning capital sources with project costs through a thorough Sources and Uses analysis can significantly boost returns in real estate investments. Properly structured sources and uses statements are essential in real estate as they provide a detailed view of where funds come from and how they are used. For instance, in a renovation project, understanding the exact renovation costs and how they are used to fund the overall project enables more efficient resource allocation, minimizing financial risks and maximizing profitability.

A well-prepared Sources and Uses table can illuminate potential areas for cost savings or efficiency improvements. This enhances decision-making and overall investment performance. Here’s how a robust Sources and Uses analysis can optimize returns:

1. Identifying Cost Overruns: By carefully tracking expenses, investors can recognize and address any cost overruns early, ensuring the project stays within budget.

2. Optimizing Funding Structure: Diverse funding sources, such as equity, debt, and grants, can strategically align with specific project costs to optimize the overall return on investment (ROI).

3. Enhancing Budget Allocation: Matching the source of funds to the type of expense (e.g., using long-term loans for fixed asset purchases) can improve liquidity and financial stability.

4. Reducing Financial Risks: A thorough sources and uses statement helps identify financial gaps, allows for timely adjustments, and reduces the likelihood of economic distress.

Integrating these practices within a Sources and Uses framework can transform the financial dynamics of real estate investments, ensuring that capital is utilized most effectively. Consequently, investors can expect improved economic performance and higher returns on their real estate ventures.

Frequently Asked Questions

What Are the Sources and Uses of Real Estate?

Sources and uses of real estate encompass the various financing options available and how they are allocated within a transaction. Sources include equity, loans, and rental income, while uses involve purchase price, construction costs, and operating expenses. Property valuation and investment strategies are critical in determining these factors. A thorough understanding guarantees that financial commitments are clear and potential risks are identified, providing a solid foundation for successful real estate investments.

What Are the Sources and Uses of a Transaction?

Sources of funds in a transaction can include the down payment, loan approval, and any external financing. Funds usually involve transaction costs, closing fees, and the principal amount required for the purchase. Ensuring a detailed breakdown of these elements is essential for accurate financial planning and transparency. This balanced approach aids in evaluating the feasibility and profitability of the transaction.

What Is the Source and Uses Statement?

The source and uses statement is critical in financial planning, detailing where funds originate and how they are allocated in a transaction. It aids in shaping an investment strategy by providing a clear picture of financial flows. This statement helps stakeholders interpret market trends and perform risk analysis, ensuring that funds’ total sources and uses are balanced for a transparent financial overview.

How to Present Sources and Uses?

To present sources and uses effectively:

- Utilize visual aids to enhance audience engagement.

- Incorporate charts or tables with clear labeling to guarantee clarity.

- Provide concise summaries that highlight key points for better comprehension.

This approach ensures that the financial data is easily digestible, aiding stakeholders in making informed decisions. These techniques can significantly improve the presentation’s impact and the audience’s understanding of the economic structure.

What Are Various Sources and Uses of Funds?

Various sources of funds in real estate include real estate crowdfunding, private equity, debt financing, and government grants. These funds can be utilized for multiple purposes, such as acquiring property, covering construction costs, servicing debt, and managing ongoing operating expenses. Additional equity might be necessary if the uses exceed available funds, ensuring a balanced capital structure and effective financial planning for real estate projects.

Conclusion

Understanding real estate financing sources and uses is vital for optimizing investment strategies. Investors can enhance returns while mitigating risks by leveraging familiar sources such as debt and equity and effectively allocating funds towards critical uses like acquisitions and development. However, prudent risk assessment and strategic planning are essential to navigate market uncertainties. Ultimately, mastering sources and uses of financing can significantly contribute to the success and sustainability of real estate ventures.

Mortgage rates

| ||||||||||||||||||||||||||||||||||||

- 1031 Exchanges in Commercial Real Estate: Strategies, Benefits, and Challenges

- A Comprehensive Guide to Commercial Property Insurance

- About

- Achieving High Performance in Commercial Real Estate Operations

- Adaptive Strategies for Commercial Real Estate Success Amid Economic Uncertainty

- Amortization in Commercial Real Estate Lending

- Apartments

- Are Commercial Real Estate Loans Fixed or Variable?

- Bad Boy Carve-Outs in Commercial Real Estate Loans

- Beyond the Lease: Cultivating Enduring Tenant Relationships in Commercial Real Estate

- Blend and Extend Agreements: An Overview

- Blog

- Breakeven Occupancy

- bridge Loans

- Class A Offices: The Pinnacle of Commercial Real Estate

- Commercial Bridge Loans: A Strategic Guide for Real Estate Investors

- Commercial Development Finance: Key Strategies and Insights for Successful Property Projects

- Commercial Hard Money Bridge Loans

- Commercial Lease Escalation Clause

- Commercial Loan Defaults

- Commercial Lockout: Understanding Legalities and Procedures in Texas Real Estate

- Commercial Mortgage Calculator

- Commercial Mortgage-Backed Securities (CMBS) Loans

- Commercial Property Improvement Loan

- Commercial Property Management: A Comprehensive Guide

- Commercial Real Estate Appraisal: A Comprehensive Guide

- Commercial Real Estate Debt Funds: A Detailed Overview

- Commercial Real Estate Underwriting: Key Metrics, Processes, and Technological Integration

- Commercial Real Estate Valuation Models

- Commercial Real Estate: The Benefits of Long-term Investment

- Commercial Real-Estate Finance Brokers

- Commercial Zoning in Real Estate: A Comprehensive Guide

- Compound Interest Real Estate

- Conditional Use Real Estate: Permits, Compliance, and Development Opportunities

- Contact Us

- Defeasing in Commercial Real Estate: Benefits, Process, and Financial Flexibility

- Double Net Lease Explained: Benefits, Responsibilities, and Strategic Insights

- E-Commerce's Profound Impact on Commercial and Industrial Real Estate

- Emerging Technologies Impacting Commercial Real Estate

- Essential Steps for Successful Due Diligence in Commercial Property Investment

- Exit Strategies for Commercial Real Estate Investors

- Exploring Commercial Equity and Equity Participation Loans

- Exploring Commercial Real Estate Marketing Strategies

- Exploring Securitization in Commercial Real Estate: A Comprehensive Overview

- Exploring Submarkets in Real Estate: Identifying Opportunities and Achieving Growth

- Fixed Interest Rates: Stability, Benefits, and Strategic Financial Planning

- Florida Commercial Hard Money Loans

- Greening the Urban Jungle: The Rise of Sustainable Buildings in Commercial Real Estate

- Gross Potential Income (GPI) in Real Estate

- Hill Creek Commercial Capital

- Historic Tax Credits (HTC) in Real Estate Development

- Hospitality Loans: Flexible Financing for Hotel Acquisition, Renovation, and Expansion

- Hotel Loans

- Houston Commercial Hard Money Loans

- How Demographic Trends Shaping Commercial Real Estate

- How the Prime Rate Impacts Real Estate Loans and Investments in 2024

- Impact of Rising Interest Rates on Commercial Real Estate

- industrial

- Investing in Health: The Unyielding Appeal of Medical Office Real Estate

- Land Loans

- Land Use Restrictive Agreements (LURA): Ensuring Long-Term Affordable Housing Stability

- Launching Your Journey in Commercial Real Estate Investment: A Beginner's Blueprint

- Lease Assignment Explained: Key Steps, Benefits, and Potential Risks in Transferring Lease Rights

- Lease-Up Loans: Essential Financing for New Multifamily Properties

- Leveraging Opportunities in Distressed Commercial Real Estate

- Life Company Loans

- Liquidity in Commercial Real Estate Markets

- Loan Holdback

- Loan Quote

- Loan types

- Low-Income Housing Tax Credit

- Mastering Commercial Real Estate Development

- Mastering Credit Risk Analysis in Commercial Real Estate Lending

- Mastering Debt Constant: A Key Metric for Loan Assessment and Financial Decision-Making

- Mastering Real Estate Market Analysis: A Guide for Investors

- Mastering the Art of Commercial Lease Negotiation

- Mastering the Art of Refinancing Commercial Real Estate Loans

- Maximizing Profits In Commercial Real Estate Through Effective Leasing Strategies

- Maximizing Profits Through Strategic Real Estate Asset Management

- Maximizing Property Value with HUD Refinancing: Benefits, Eligibility, and Process

- Maximizing Rental Property Investment with SBA 504 Loans: Benefits and Eligibility Criteria

- Maximizing Returns in Real Estate: The Strategic Approach of CRE Multifamily in the Evolving Market

- Maximizing Returns: The Tax Advantages of Commercial Real Estate Investment

- Miami Commercial Hard Money Loans

- mortgage rates

- New York Commercial Hard Money Loans

- Office

- Office Real Estate Investment: Key Factors, Strategies, and Market Insights for Success

- Opportunity Zone Loans: Maximizing Tax Benefits and Investment Potential

- Optimizing Real Estate Investments: Key Structures and Strategies for Successful Partnerships

- Pari Passu in Real Estate: Ensuring Fair and Equitable Investment Strategies

- Permanant Financing

- Physical Vs. Economic Occupancy: A Comprehensive Analysis

- Portfolio Diversification with Commercial Real Estate

- Preparing for the Future: Commercial Real Estate and Climate Change

- Prepayment Penalties in Commercial Real Estate Financing

- Privacy Policy

- Promoted Structure in Commercial Real Estate: Aligning Interests and Maximizing Returns

- Real Estate Joint Ventures: Strategies, Structures, and Key Considerations

- Recourse and Non-Recourse Financing in Commercial Real Estate

- REITs vs. Direct Investment in Commercial Real Estate: Comparing investment vehicles and their implications

- Restaurant Financing: An Essential Guide for Culinary Ventures

- Retail

- Revitalizing Commercial Real Estate: A Guide to Enhancing Value in the Digital Era

- Revolutionizing the Secondary CRE Market: Unleashing Potential Amid Change

- Sale Leaseback Commercial Real Estate

- SBA 504

- SBA 7A

- Self-storage financing

- SOFR in Real Estate: Understanding the Transition from LIBOR and Its Industry Implications

- Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

- ssuming SBA Loans: Conditions, Benefits, and Risks Explained

- Texas Commercial Hard Money Loans

- The Complexities of Commercial Real Estate Syndication and Syndicated Loans

- the Due Diligence Process in Commercial Real Estate Investments

- The Regulatory Terrain: Mastering Real Estate Development and Investment in Today's World

- The Rise of Mixed-Use Developments in Urban Commercial Real Estate

- Thriving in Downturns: The Counterintuitive Appeal of Commercial Real Estate Investment During Recessions

- Transforming Spaces: The Evolution of Office Real Estate in a Post-COVID World

- Transforming Urban Landscapes through Commercial Real Estate Repurposing

- Understanding Anchor Tenants: Key Benefits and Strategies for Commercial Real Estate Success

- Understanding Base Year Stop in Commercial Leases: Benefits, Risks, and Cost Management

- Understanding BOMA Standards in Real Estate: Accurate Measurements and Enhanced Leasing Strategies

- Understanding CAM Charges in Commercial Real Estate

- Understanding Cap Rates in Commercial Real Estate Investment

- Understanding Commercial Loan Origination Fees in Real Estate

- Understanding Debt Service Coverage Ratio (DSCR) in Real Estate Investing

- Understanding Debt Yield in Commercial Real Estate Finance

- Understanding Fixed vs. Variable Interest Rates in Finance

- Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

- Understanding Ground Leases in Commercial Real Estate

- Understanding Load Factor in Real Estate: Impact on Leasing and Space Utilization

- Understanding Mezzanine Financing in Real Estate: Balancing Risk and Reward for Optimal Investment

- Understanding NPV in Real Estate: Calculating Profitability and Making Informed Investment Decisions

- Understanding Preferred Equity: Balancing Risk and Reward in Your Investment Portfolio

- Understanding Real Estate Limited Partnerships (RELPs): Benefits, Structure, and Investment Potentia

- Understanding Recapture Clauses in Commercial Leases: Benefits and Implementation Strategies

- Understanding Rent Ceilings: Balancing Affordability and Landlord Interests in Housing Policy

- Understanding the 2% Rule in Real Estate Investing: Maximizing Profitability and Cash Flow

- Unlocking Opportunities: A Deep Dive into Real Estate Crowdfunding Introduction

- Unlocking the Potential of Infill Real Estate: Strategies for Sustainable Urban Development

- Unlocking the Potential of Shadow Space: Strategies for Maximizing Real Estate Profitability

- Unveiling the Economic Titan: The Role of Commercial Real Estate

- We are negotiating Commercial Real Estate Deals: Techniques and tips for effective negotiation.

- What Is a Balloon Payment on a Commercial Loan

- What Is a Power Center in Real Estate?

- What Is Impact Investing in Commercial Real Estate

- Working from home May Adapt to Office Real Estate