In This Article

- What are CAM Charges

- Components of CAM Charges

- Types of CAM Structures

- Calculation of CAM Charges

- Lease Types and CAM Charges

- Impact of Lease Type on CAM Charges and Tenant Responsibilities

- Negotiating CAM Charges

- Tips for Landlords

- Impact of CAM Charges on Financials

- Best Practices for Managing CAM Charges

- Conclusion

- Get a Loan Quote Now!

Call or Email Us at

By Georin Sanders Last updated on August 12, 2024

Understanding CAM Charges in Commercial Real Estate

Common Area Maintenance (CAM) charges in commercial real estate are a crucial component of lease agreements, encompassing costs related to the upkeep and operation of shared spaces within a property. These charges typically include expenses for maintaining lobbies, hallways, parking lots, landscaping, and other communal areas. Understanding CAM charges is vital for landlords and tenants as they directly impact the financial dynamics of leasing agreements. Accurate allocating and managing these charges for landlords ensures the property remains well-maintained and appealing to current and prospective tenants. For tenants, a clear comprehension of CAM charges aids in budgeting and prevents unexpected financial burdens, fostering a transparent and mutually beneficial landlord-tenant relationship.

Key Takeaways

- CAM Charges: Cover shared space upkeep, impacting leases and financial planning.

- Components: Maintenance, insurance, repairs, security, landscaping, snow removal, utilities.

- Types: Fixed, Variable, Cumulative Cap, Compounding Cap.

- Calculation: Pro-rata based on leased space; accurate square footage crucial.

- Lease Types: Full-service (included), Triple net (separate), Double net (shared).

- Reconciliation: Annual expense comparison; adjust for over/underpayment.

- Negotiation: Research and negotiate terms; ensure transparency.

- Property Types: Office (janitorial, utilities), Retail (parking, landscaping), Industrial (maintenance).

- Financial Impact: Affect NOI and tenant costs; consider ASC 842.

- Best Practices: Accurate records, regular inspections, preventive maintenance, transparent communication.

What are CAM Charges

Common Area Maintenance (CAM) charges refer to the fees tenants pay to cover the expenses of maintaining and operating a commercial property’s common areas. Common areas include shared spaces such as lobbies, hallways, elevators, restrooms, parking lots, sidewalks, landscaping, and other facilities used by multiple tenants.

The primary purpose of CAM charges is to ensure that these shared spaces are kept in good condition, clean, safe, and operational for all tenants and visitors. CAM charges are crucial in property management as they help distribute the maintenance and upkeep costs equitably among all tenants. This ensures that the property remains attractive and functional and allows landlords to manage the financial aspects of property maintenance effectively. By understanding CAM charges, tenants can better anticipate their total occupancy costs and budget accordingly, while landlords can maintain the property’s value and appeal.

Components of CAM Charges

CAM charges encompass a variety of expenses necessary for the upkeep and efficient operation of the common areas within commercial properties. These charges typically include:

Property Maintenance: Costs associated with the routine upkeep of shared spaces, such as cleaning services for lobbies, hallways, and restrooms, as well as maintaining lighting, HVAC systems, and elevators.

Insurance: Premiums for insurance policies that cover common areas, protecting against liability and property damage.

Repairs: Expenses for fixing any issues in common areas, including plumbing, electrical, and structural repairs.

Administrative Fees: Costs related to managing CAM activities, such as accounting, billing, and the administrative tasks performed by property managers.

Security Services: Fees for security personnel, surveillance systems, and other measures to ensure the safety of tenants and visitors.

Landscaping: Expenses for maintaining outdoor areas, including lawn care, tree trimming, and flower bed upkeep.

Snow Removal: Costs associated with clearing snow and ice from parking lots, walkways, and entrances to ensure safety during winter months.

Utilities for Common Areas: Charges for electricity, water, heating, and cooling used in common areas, ensuring these spaces are functional and comfortable.

The components of CAM charges can vary significantly depending on the type of property:

Office Spaces: CAM charges often include higher administrative fees and security costs due to the need for controlled access and professional environments.

Retail Spaces: Retail properties might have higher landscaping and property maintenance costs to ensure a pleasant shopping experience and curb appeal.

Industrial Properties: These typically incur lower landscaping costs but may have higher expenses for large-scale repairs and utilities, given the nature of industrial operations.

Understanding the specific components and variations of CAM charges based on property type helps landlords and tenants accurately anticipate and manage these expenses, ensuring a fair and efficient distribution of costs associated with maintaining shared spaces.

Types of CAM Structures

Understanding the different types of CAM (Common Area Maintenance) structures is essential for both landlords and tenants, as it directly impacts financial planning and lease negotiations. Here are the primary CAM structures:

Fixed CAM: In this structure, CAM charges are predetermined and remain constant throughout the lease term. Tenants benefit from predictable monthly expenses, which simplifies budgeting. However, landlords might incorporate a cushion in the charges to cover potential increases in maintenance costs, ensuring they are not at a financial loss if expenses rise unexpectedly.

Variable CAM: Unlike fixed CAM, variable CAM charges can fluctuate based on the actual expenses incurred for maintaining the common areas. This structure requires tenants to share the cost variability, which can lead to higher or lower payments depending on the maintenance needs and cost changes over time. While this reflects the real costs more accurately, it can make budgeting more challenging for tenants.

Cumulative Cap: This structure limits the annual increase in CAM charges based on projected expenses, often agreed upon at the start of the lease. For instance, a cumulative cap might limit CAM increases to a certain percentage each year, regardless of the actual increase in expenses. This gives tenants a degree of predictability while allowing landlords to adjust for inflation and rising costs.

Compounding Cap: Similar to the cumulative cap, the compounding cap limits annual CAM charge increases but allows these increases to compound over time. For example, if a 5% compounding cap is set, the increase for each subsequent year will be 5% of the previous year’s CAM charges. This structure tends to favor landlords more, as it ensures a steady growth in CAM revenue while providing some predictability for tenants.

Understanding these CAM structures helps tenants negotiate better lease terms and plan their budgets more effectively. For landlords, choosing the right structure can balance the need for cost recovery with tenant retention and satisfaction. Each structure has its benefits and drawbacks, and the choice often depends on the specific needs and financial strategies of both parties involved in the lease.

Calculation of CAM Charges

Calculating CAM (Common Area Maintenance) charges accurately is critical for ensuring fair distribution of maintenance costs among tenants and for maintaining transparent financial operations. Here are the key aspects of CAM charge calculations:

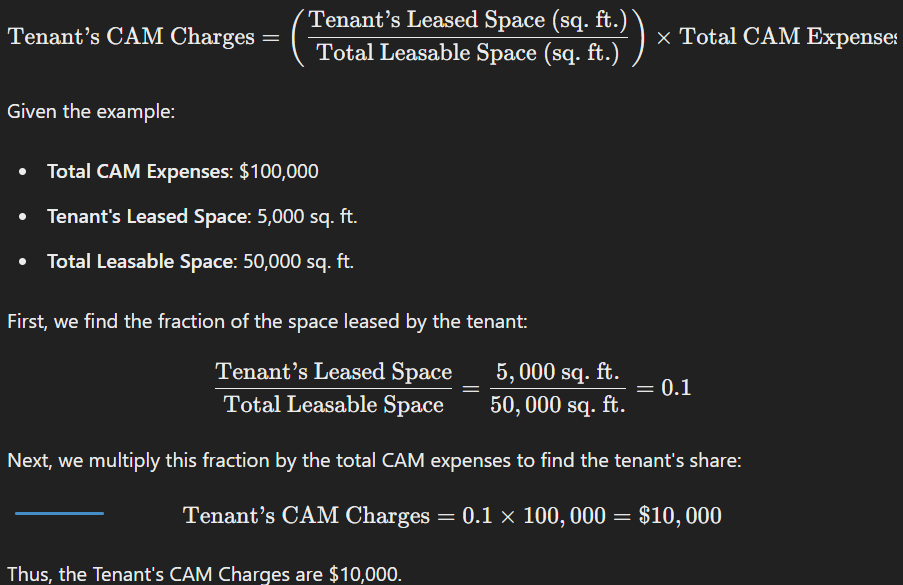

Pro-rata Basis Calculation: CAM charges are typically calculated on a pro-rata basis, meaning each tenant pays a portion of the total CAM expenses based on the amount of space they lease within the property. The formula for this calculation is:

Impact of Tenant’s Leased Space on CAM Responsibility: The larger the tenant’s leased space, the higher their share of CAM charges. This proportional approach ensures that all tenants contribute to the upkeep of the common areas.

Importance of Accurate Square Footage Assessment:

Accurate measurement of the tenant’s leased space and the total leasable space is crucial. Discrepancies in square footage can lead to incorrect CAM charges, potentially causing disputes between landlords and tenants. Having professional measurements and clear definitions of leasable areas in lease agreements is advisable.

Role of Property Managers in Forecasting and Reconciling CAM Charges: Property managers play a vital role in the CAM charge process. They are responsible for:

Forecasting: Estimating the annual CAM expenses based on historical data, anticipated maintenance, and market trends. This helps set initial CAM charges and budget for the year.

Reconciling: At the end of the year, property managers compare the estimated CAM charges with the actual expenses incurred. Adjustments are made if the actual costs are higher or lower than the estimated charges. Tenants may receive a refund for overpayment or be billed for any shortfall.

Accurate forecasting and reconciliation help maintain transparency and trust between landlords and tenants, ensuring that CAM charges reflect the actual cost of keeping the property. Proper documentation and communication during this process are essential for minimizing disputes and fostering a cooperative landlord-tenant relationship.

Lease Types and CAM Charges

Understanding the different types of leases in commercial real estate is essential, as the lease type directly affects how CAM (Common Area Maintenance) charges are handled and the overall financial responsibilities of tenants. Here are the main lease types and their implications for CAM charges:

Full-service (gross) leases: In a full-service or gross lease, all operating expenses, including CAM charges, property taxes, and insurance, are included in the tenant’s base rent. This means tenants pay a single, all-inclusive rent amount, simplifying budgeting and eliminating the need for separate payments for CAM charges. Landlords are responsible for managing and covering all these expenses, providing tenants with cost predictability. However, landlords may set higher base rents to cover these comprehensive expenses.

Triple net (NNN) leases: Under a triple net lease, tenants are responsible for paying CAM charges, property taxes, and insurance premiums in addition to the base rent. This lease type shifts a significant portion of the financial burden to the tenants, making them directly responsible for their share of the building’s operating expenses. Calculating each tenant’s share of these expenses is typically based on their pro-rata share of the leased space. Triple net leases provide landlords with more predictable net income, as the tenants cover the variable expenses.

Double net (NN) leases: In a double net lease, tenants are responsible for paying property taxes and insurance premiums but not CAM charges. The landlord covers CAM expenses, which are included in the base rent. This lease type balances the landlord’s and tenants’ financial responsibilities, with tenants bearing some operating costs while the landlord manages the standard area maintenance.

Impact of Lease Type on CAM Charges and Tenant Responsibilities

The type of lease agreement significantly impacts how CAM charges are managed and the overall financial responsibilities of tenants:

Budgeting and Cost Predictability:

- Tenants with full-service leases benefit from predictable monthly costs, as all expenses are bundled into a single rent payment.

- Tenants with triple net leases face more variable costs, as they must account for fluctuating CAM charges, property taxes, and insurance premiums. This can complicate budgeting but allows tenants to see a detailed breakdown of their expenses.

- Double net leases offer a middle ground, with some cost predictability regarding CAM charges but variability in property taxes and insurance.

Responsibility and Control:

- Full-service leases place the least financial responsibility on tenants, giving landlords complete control over property maintenance and associated costs.

- Triple net leases give tenants more responsibility and control over their expenses. Tenants may be more incentivized to monitor and influence the management of common areas to keep costs down.

- Double net leases split responsibilities, with tenants handling property taxes and insurance while landlords control CAM-related expenses.

Negotiation and Flexibility:

- Lease negotiations for full-service leases focus more on the base rent amount, encompassing all expenses.

- Triple net leases require detailed negotiations on the specific CAM charges, property taxes, and insurance, providing tenants with opportunities to negotiate caps or limits on annual increases.

- Double net leases involve negotiations for both base rent and the specific expenses tenants will cover, offering a balance of simplicity and shared financial responsibility.

Understanding these lease types helps tenants and landlords choose the best arrangement for their financial strategies and property management preferences, ensuring a transparent and fair allocation of expenses.

CAM Reconciliation and Adjustments

CAM (Common Area Maintenance) reconciliation and adjustments are critical in managing commercial real estate leases. They ensure tenants only pay their fair share of expenses incurred for maintaining common areas. Here’s a detailed look at the CAM reconciliation and adjustment process:

Annual Reconciliation Process

Comparison of Estimated vs. Actual Expenses: At the beginning of each year, landlords typically estimate the CAM expenses based on historical data and anticipated costs. Tenants are then billed monthly or quarterly based on these estimates. At the end of the year, a reconciliation process takes place where the actual CAM expenses incurred are compared to the estimated amounts collected from tenants.

Adjustments and Credits/Debits for Overpayment or Underpayment: If the actual expenses exceed the estimated amounts, tenants will owe the difference, resulting in a debit. Conversely, if the quantities estimated collected exceed the actual costs, tenants will receive a credit or refund. This adjustment ensures tenants pay what is needed to cover their share of CAM expenses without overpaying or underpaying.

Example Calculation:

– Estimated CAM Charges for the Year: $120,000

– Actual CAM Expenses Incurred: $110,000

– Total Amount Collected from Tenants: $120,000

In this example, the tenants collectively overpaid by $10,000. Therefore, tenants would receive credits for the overpayment.

Importance of Proactive Property Management in Avoiding Large Year-End Adjustments:

Regular Monitoring and Adjustments: Proactive property management involves regularly monitoring CAM expenses throughout the year and making periodic adjustments to estimates as needed. This practice helps keep the estimates more aligned with actual costs, reducing the likelihood of significant year-end adjustments.

Transparent Communication: Maintaining open and transparent communication with tenants regarding CAM charges and potential variances helps build trust and prevent disputes. Regular updates and detailed breakdowns of expenses can enhance tenants’ understanding and acceptance of CAM charges.

Preventive Maintenance and Cost Control: Proactive property managers focus on preventive maintenance and cost control measures to avoid unexpected significant expenses. Regular inspections, timely repairs, and efficient resource management can help keep CAM expenses within budget.

Accurate Record-Keeping: Keeping detailed and accurate records of all CAM-related expenses and activities ensures a smooth reconciliation process. Proper documentation helps verify expenses and justify any needed adjustments.

By implementing these proactive management strategies, landlords can minimize the chances of significant discrepancies between estimated and actual CAM expenses. This not only ensures a fair financial arrangement for tenants but also fosters a cooperative and transparent landlord-tenant relationship, ultimately contributing to the smooth operation and upkeep of the property.

Negotiating CAM Charges

Negotiating CAM (Common Area Maintenance) charges is critical to commercial lease agreements. Tenants and landlords must approach these negotiations clearly and understand their goals and the market standards. Here are some tips for both parties:

Tips for Tenants:

Researching CAM Structures and Negotiating Terms: Before entering negotiations, tenants should research different CAM structures (fixed, variable, cumulative, and compounding caps) and understand how each might impact their expenses. With this knowledge, tenants can better negotiate terms aligning with their budget and operational needs.

Establishing Caps on CAM Increases: Tenants can negotiate for caps on annual CAM increases to limit their financial exposure. These could include cumulative caps, which limit the total increase year over year, or compounding caps, which set a fixed percentage increase. Establishing these caps can help tenants manage their long-term expenses more predictably.

Verifying Square Footage and Calculations: Tenants should confirm the accuracy of their leased space measurements and the total leasable space of the property. Accurate square footage is essential for calculating a fair share of CAM charges. Tenants should also review the landlord’s CAM expense estimates and reconciliation procedures to ensure transparency and accuracy.

Tips for Landlords

Including Necessary Expenses in CAM to Cover Maintenance Costs: Landlords should ensure that all necessary expenses for maintaining the property are included in the CAM charges. This includes property maintenance, insurance, repairs, administrative fees, security services, landscaping, snow removal, and utilities for common areas. Comprehensive coverage ensures that the property remains well-maintained without unexpected financial shortfalls.

Setting Reasonable CAM Caps to Attract Tenants: To make the property attractive to potential tenants, landlords can set reasonable caps on CAM increases. These caps should be high enough to cover inflation and rising costs but low enough to provide tenants with financial predictability. Reasonable CAM caps can be a strong selling point in lease negotiations and help retain tenants long-term.

By following these tips, tenants and landlords can achieve a fair and mutually beneficial agreement on CAM charges, ensuring the smooth operation and maintenance of the property while maintaining financial stability and transparency.

CAM Charges in Different Property Types

Common Area Maintenance (CAM) charges vary significantly based on the type of commercial property, reflecting the unique maintenance and operational needs of each property type:

Office Spaces: CAM charges for office spaces typically include janitorial services, utilities (such as electricity and water for common areas), HVAC maintenance, elevator servicing, and general upkeep of lobbies, restrooms, and other shared facilities. These charges ensure that office environments remain clean, functional, and comfortable for tenants and their clients.

Retail Spaces: Retail properties often incur CAM charges for maintaining parking lots, sidewalks, and delivery areas, essential for customer access and logistics. Additionally, these charges cover the maintenance of common areas like food courts, public restrooms, and indoor/outdoor seating areas. Retail CAM charges are critical for providing a pleasant shopping experience and supporting high customer foot traffic.

Industrial Spaces: CAM charges in industrial properties primarily focus on basic maintenance needs such as exterior lighting, landscaping, and parking lot upkeep. These spaces may also require specialized maintenance for loading docks, storage areas, and industrial equipment. The goal is to ensure that industrial facilities remain operational and safe for tenants’ logistical and manufacturing activities.

Impact of CAM Charges on Financials

Influence on Net Operating Income (NOI) for Landlords: CAM charges directly affect a landlord’s net operating income (NOI), the total revenue generated from the property minus operating expenses. Efficient management of CAM expenses can enhance NOI by reducing the overall cost burden while ensuring high property standards.

Impact on Tenant’s Overall Occupancy Costs: CAM charges contribute to their total occupancy costs, including base rent and additional expenses. High CAM charges can significantly impact a tenant’s budget and financial planning. Understanding and negotiating these charges is crucial for tenants to manage their total occupancy cost-effectively.

Lease Accounting Implications under ASC 842: The Financial Accounting Standards Board’s (FASB) ASC 842 lease accounting standard requires tenants to recognize assets and liabilities for leases longer than 12 months. This standard affects how tenants account for CAM charges, as these expenses may need to be included in the lease liability calculation, impacting financial statements and compliance requirements.

Best Practices for Managing CAM Charges

Maintaining Accurate Records and Reports: Keeping detailed records of all CAM-related expenses and providing transparent, itemized reports to tenants helps prevent disputes and ensures accountability. Accurate documentation is essential for annual reconciliation processes and for justifying CAM charges.

Regular Property Inspections and Preventive Maintenance: Regular inspections and the implementation of preventive maintenance programs help identify potential issues early and reduce unexpected repair costs. Proactive maintenance ensures the property remains in good condition and minimizes the risk of costly emergencies.

Transparent Communication Between Landlords and Tenants: Open and regular communication between landlords and tenants regarding CAM charges fosters trust and cooperation. Landlords should provide clear explanations of CAM expenses, share forecasts, and discuss any potential changes in charges. Transparent communication helps tenants understand their financial responsibilities and can facilitate smoother lease negotiations and renewals.

By following these best practices and understanding different property types’ specific needs, landlords and tenants can manage CAM charges more effectively, ensuring fair cost distribution and maintaining high property standards.

Conclusion

Understanding and managing CAM (Common Area Maintenance) charges is essential for landlords and commercial real estate tenants. Properly handling these charges ensures properties’ smooth operation and maintenance, leading to fair financial arrangements and long-term satisfaction for all parties involved.

Recap of the Importance of Understanding and Managing CAM Charges

CAM charges cover crucial expenses related to the maintenance and upkeep of shared areas within commercial properties. These charges can significantly impact landlords’ net operating income (NOI) and tenants’ overall occupancy costs. By understanding the components, calculation methods, and implications of CAM charges, both landlords and tenants can make informed decisions, negotiate better lease terms, and avoid unexpected financial burdens.

Final Tips for Landlords and Tenants to Ensure Fair and Predictable CAM Expenses

For Landlords:

Include Comprehensive and Necessary Expenses: Ensure all relevant expenses are included in CAM charges to cover maintenance and operational costs effectively. This practice prevents unexpected shortfalls and maintains property standards.

Set Reasonable CAM Caps: Establish reasonable caps on CAM increases to attract and retain tenants. This helps provide tenants with cost predictability while allowing landlords to manage rising expenses.

Maintain Accurate Records: Keep detailed records of all CAM expenses and provide transparent reports to tenants. This transparency builds trust and simplifies the reconciliation process.

For Tenants:

Research and Negotiate Terms: Understand different CAM structures and negotiate terms that align with your financial planning. Establishing caps on CAM increases and verifying square footage calculations can help manage expenses effectively.

Monitor and Verify Expenses: Regularly review CAM charges and request detailed breakdowns from landlords. This proactive approach ensures that charges are fair and accurate.

Communicate Openly with Landlords: Maintain open communication with landlords regarding CAM charges and any potential changes. Transparent dialogue helps prevent misunderstandings and fosters a cooperative relationship.

By adhering to these tips and best practices, landlords and tenants can achieve a balanced, fair, and predictable approach to CAM charges, ultimately contributing to commercial properties’ successful management and sustainability.

Mortgage rates

| ||||||||||||||||||||||||||||||||||||

- 1031 Exchanges in Commercial Real Estate: Strategies, Benefits, and Challenges

- A Comprehensive Guide to Commercial Property Insurance

- About

- Achieving High Performance in Commercial Real Estate Operations

- Adaptive Strategies for Commercial Real Estate Success Amid Economic Uncertainty

- Amortization in Commercial Real Estate Lending

- Apartments

- Are Commercial Real Estate Loans Fixed or Variable?

- Bad Boy Carve-Outs in Commercial Real Estate Loans

- Beyond the Lease: Cultivating Enduring Tenant Relationships in Commercial Real Estate

- Blend and Extend Agreements: An Overview

- Blog

- Breakeven Occupancy

- bridge Loans

- Class A Offices: The Pinnacle of Commercial Real Estate

- Commercial Bridge Loans: A Strategic Guide for Real Estate Investors

- Commercial Development Finance: Key Strategies and Insights for Successful Property Projects

- Commercial Hard Money Bridge Loans

- Commercial Lease Escalation Clause

- Commercial Loan Defaults

- Commercial Lockout: Understanding Legalities and Procedures in Texas Real Estate

- Commercial Mortgage Calculator

- Commercial Mortgage-Backed Securities (CMBS) Loans

- Commercial Property Improvement Loan

- Commercial Property Management: A Comprehensive Guide

- Commercial Real Estate Appraisal: A Comprehensive Guide

- Commercial Real Estate Debt Funds: A Detailed Overview

- Commercial Real Estate Underwriting: Key Metrics, Processes, and Technological Integration

- Commercial Real Estate Valuation Models

- Commercial Real Estate: The Benefits of Long-term Investment

- Commercial Real-Estate Finance Brokers

- Commercial Zoning in Real Estate: A Comprehensive Guide

- Compound Interest Real Estate

- Conditional Use Real Estate: Permits, Compliance, and Development Opportunities

- Contact Us

- Defeasing in Commercial Real Estate: Benefits, Process, and Financial Flexibility

- Double Net Lease Explained: Benefits, Responsibilities, and Strategic Insights

- E-Commerce's Profound Impact on Commercial and Industrial Real Estate

- Emerging Technologies Impacting Commercial Real Estate

- Essential Steps for Successful Due Diligence in Commercial Property Investment

- Exit Strategies for Commercial Real Estate Investors

- Exploring Commercial Equity and Equity Participation Loans

- Exploring Commercial Real Estate Marketing Strategies

- Exploring Securitization in Commercial Real Estate: A Comprehensive Overview

- Exploring Submarkets in Real Estate: Identifying Opportunities and Achieving Growth

- Fixed Interest Rates: Stability, Benefits, and Strategic Financial Planning

- Florida Commercial Hard Money Loans

- Greening the Urban Jungle: The Rise of Sustainable Buildings in Commercial Real Estate

- Gross Potential Income (GPI) in Real Estate

- Hill Creek Commercial Capital

- Historic Tax Credits (HTC) in Real Estate Development

- Hospitality Loans: Flexible Financing for Hotel Acquisition, Renovation, and Expansion

- Hotel Loans

- Houston Commercial Hard Money Loans

- How Demographic Trends Shaping Commercial Real Estate

- How the Prime Rate Impacts Real Estate Loans and Investments in 2024

- Impact of Rising Interest Rates on Commercial Real Estate

- industrial

- Investing in Health: The Unyielding Appeal of Medical Office Real Estate

- Land Loans

- Land Use Restrictive Agreements (LURA): Ensuring Long-Term Affordable Housing Stability

- Launching Your Journey in Commercial Real Estate Investment: A Beginner's Blueprint

- Lease Assignment Explained: Key Steps, Benefits, and Potential Risks in Transferring Lease Rights

- Lease-Up Loans: Essential Financing for New Multifamily Properties

- Leveraging Opportunities in Distressed Commercial Real Estate

- Life Company Loans

- Liquidity in Commercial Real Estate Markets

- Loan Holdback

- Loan Quote

- Loan types

- Low-Income Housing Tax Credit

- Mastering Commercial Real Estate Development

- Mastering Credit Risk Analysis in Commercial Real Estate Lending

- Mastering Debt Constant: A Key Metric for Loan Assessment and Financial Decision-Making

- Mastering Real Estate Market Analysis: A Guide for Investors

- Mastering the Art of Commercial Lease Negotiation

- Mastering the Art of Refinancing Commercial Real Estate Loans

- Maximizing Profits In Commercial Real Estate Through Effective Leasing Strategies

- Maximizing Profits Through Strategic Real Estate Asset Management

- Maximizing Property Value with HUD Refinancing: Benefits, Eligibility, and Process

- Maximizing Rental Property Investment with SBA 504 Loans: Benefits and Eligibility Criteria

- Maximizing Returns in Real Estate: The Strategic Approach of CRE Multifamily in the Evolving Market

- Maximizing Returns: The Tax Advantages of Commercial Real Estate Investment

- Miami Commercial Hard Money Loans

- mortgage rates

- New York Commercial Hard Money Loans

- Office

- Office Real Estate Investment: Key Factors, Strategies, and Market Insights for Success

- Opportunity Zone Loans: Maximizing Tax Benefits and Investment Potential

- Optimizing Real Estate Investments: Key Structures and Strategies for Successful Partnerships

- Pari Passu in Real Estate: Ensuring Fair and Equitable Investment Strategies

- Permanant Financing

- Physical Vs. Economic Occupancy: A Comprehensive Analysis

- Portfolio Diversification with Commercial Real Estate

- Preparing for the Future: Commercial Real Estate and Climate Change

- Prepayment Penalties in Commercial Real Estate Financing

- Privacy Policy

- Promoted Structure in Commercial Real Estate: Aligning Interests and Maximizing Returns

- Real Estate Joint Ventures: Strategies, Structures, and Key Considerations

- Recourse and Non-Recourse Financing in Commercial Real Estate

- REITs vs. Direct Investment in Commercial Real Estate: Comparing investment vehicles and their implications

- Restaurant Financing: An Essential Guide for Culinary Ventures

- Retail

- Revitalizing Commercial Real Estate: A Guide to Enhancing Value in the Digital Era

- Revolutionizing the Secondary CRE Market: Unleashing Potential Amid Change

- Sale Leaseback Commercial Real Estate

- SBA 504

- SBA 7A

- Self-storage financing

- SOFR in Real Estate: Understanding the Transition from LIBOR and Its Industry Implications

- Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

- ssuming SBA Loans: Conditions, Benefits, and Risks Explained

- Texas Commercial Hard Money Loans

- The Complexities of Commercial Real Estate Syndication and Syndicated Loans

- the Due Diligence Process in Commercial Real Estate Investments

- The Regulatory Terrain: Mastering Real Estate Development and Investment in Today's World

- The Rise of Mixed-Use Developments in Urban Commercial Real Estate

- Thriving in Downturns: The Counterintuitive Appeal of Commercial Real Estate Investment During Recessions

- Transforming Spaces: The Evolution of Office Real Estate in a Post-COVID World

- Transforming Urban Landscapes through Commercial Real Estate Repurposing

- Understanding Anchor Tenants: Key Benefits and Strategies for Commercial Real Estate Success

- Understanding Base Year Stop in Commercial Leases: Benefits, Risks, and Cost Management

- Understanding BOMA Standards in Real Estate: Accurate Measurements and Enhanced Leasing Strategies

- Understanding CAM Charges in Commercial Real Estate

- Understanding Cap Rates in Commercial Real Estate Investment

- Understanding Commercial Loan Origination Fees in Real Estate

- Understanding Debt Service Coverage Ratio (DSCR) in Real Estate Investing

- Understanding Debt Yield in Commercial Real Estate Finance

- Understanding Fixed vs. Variable Interest Rates in Finance

- Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

- Understanding Ground Leases in Commercial Real Estate

- Understanding Load Factor in Real Estate: Impact on Leasing and Space Utilization

- Understanding Mezzanine Financing in Real Estate: Balancing Risk and Reward for Optimal Investment

- Understanding NPV in Real Estate: Calculating Profitability and Making Informed Investment Decisions

- Understanding Preferred Equity: Balancing Risk and Reward in Your Investment Portfolio

- Understanding Real Estate Limited Partnerships (RELPs): Benefits, Structure, and Investment Potentia

- Understanding Recapture Clauses in Commercial Leases: Benefits and Implementation Strategies

- Understanding Rent Ceilings: Balancing Affordability and Landlord Interests in Housing Policy

- Understanding the 2% Rule in Real Estate Investing: Maximizing Profitability and Cash Flow

- Unlocking Opportunities: A Deep Dive into Real Estate Crowdfunding Introduction

- Unlocking the Potential of Infill Real Estate: Strategies for Sustainable Urban Development

- Unlocking the Potential of Shadow Space: Strategies for Maximizing Real Estate Profitability

- Unveiling the Economic Titan: The Role of Commercial Real Estate

- We are negotiating Commercial Real Estate Deals: Techniques and tips for effective negotiation.

- What Is a Balloon Payment on a Commercial Loan

- What Is a Power Center in Real Estate?

- What Is Impact Investing in Commercial Real Estate

- Working from home May Adapt to Office Real Estate