In This Article

Understanding Cap Rates in Commercial Real Estate Investment

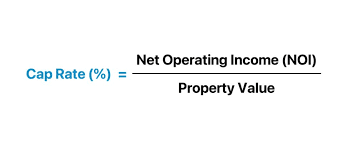

The capitalization rate, commonly known as the cap rate, is a fundamental metric for evaluating commercial real estate investments. It measures the expected return on an investment property independent of financing, providing a snapshot of its potential profitability. Calculated by dividing the property’s annual net operating income (NOI) by its current market value, cap rates are crucial for investors assessing real estate assets’ risk and return profile.

Understanding cap rates is essential for anyone involved in commercial real estate, from seasoned investors to novices. This metric helps compare the relative attractiveness of different investment opportunities and is pivotal in strategic decision-making. High cap rates typically indicate higher potential returns, albeit often at higher risks, whereas lower cap rates suggest a safer investment but with potentially lower yields. By mastering the interpretation and application of cap rates, investors can make more informed choices, aligning their investment strategies with their financial goals and risk tolerance.

Defining Cap Rates

Cap rates, or capitalization rates, are a fundamental metric used extensively in commercial real estate to evaluate the potential return on an investment property. This rate provides a snapshot of the property’s yield in a year without accounting for future income increases, expenses, or financing methods, making it an essential tool for comparing different real estate opportunities.

What are Cap Rates?

Cap rates are expressed as a percentage and represent the ratio of a property’s Net Operating Income (NOI) to its current market value. This key metric helps investors assess a property’s risk and return profile by indicating how long it will take to recoup their investment based on the income the property generates.

- Net Operating Income (NOI) is the total income derived from the property minus operating expenses. NOI is crucial as it reflects the property’s actual income-producing potential, excluding any financing costs or capital expenditures.

- Current Market Value: The property’s present value or sale price. Market conditions, location, property conditions, and the current real estate market cycle can influence it.

Interpretation and Usage:

- Understanding Cap Rates: A higher cap rate indicates a potentially higher return rate and risk. Conversely, a lower cap rate suggests a safer investment but usually offers a lower return.

- Application in Real Estate: Investors use cap rates to compare the potential ROI of different properties within the same market or to gauge a property’s performance against regional or national averages. This is particularly useful in volatile markets or where rental income varies significantly.

Factors Influencing Cap Rates

Cap rates are influenced by myriad factors that can either increase or decrease their value. They reflect the perceived risk and potential return on an investment property. Understanding these variables is crucial for investors to assess and compare investment opportunities accurately.

Key Variables Affecting Cap Rates

- Location: The geographic location of a property plays a critical role in determining its cap rate. Properties in high-demand, low-risk areas typically have lower cap rates due to their perceived stability and lower risk. Conversely, properties in less desirable areas may have higher cap rates to compensate for higher perceived risks.

- Asset Type: Different properties experience different levels of demand and risk, which can affect their cap rates. For instance, multi-family homes may have lower cap rates than commercial office spaces due to their consistent demand and lower vacancy rates.

- Tenant Quality: Tenant creditworthiness and stability can significantly impact cap rates. Properties leased to high-quality tenants with long-term leases (such as national chains or government agencies) typically command lower cap rates due to the reduced risk of default.

Impact of Macroeconomic Factors

- Interest Rates: A robust inverse relationship exists between interest and cap rates. When interest rates rise, the cost of borrowing increases, which can lessen investment appeal and drive cap rates higher as investors demand higher returns to offset increased costs.

- Economic Conditions: Overall economic health can also affect cap rates. In robust economies, property demand increases, potentially driving down cap rates due to increased competition for real estate investments. Conversely, cap rates may rise in recessions as the risk of tenant defaults grows and property values decline.

- Market Sentiment and Trends: Investor perception and sentiment about the real estate market and broader economic trends can influence cap rates. For example, if investors feel optimistic about the commercial real estate market’s growth, they might be willing to accept lower returns, leading to lower cap rates.

Using Cap Rates in Investment Decisions

Cap rates are a pivotal tool in the arsenal of real estate investors, providing essential insights into the potential returns and risks associated with various investment opportunities. This section explores how investors use cap rates to guide their decision-making process and how comparing cap rates across different properties can inform investment strategies.

Assessing Potential Returns on Investment

- Risk Assessment and Return Projection: Cap rates offer a direct metric for assessing a property’s risk and expected return. A higher cap rate generally suggests a higher potential return, reflecting higher risk, such as in properties in less developed areas or with unstable tenancies. Conversely, a lower cap rate indicates a safer investment, commonly seen in well-established, low-risk areas with stable rental incomes.

- Benchmarking Against Market Averages: Investors use cap rates to gauge whether a property is priced appropriately relative to the market. By comparing a property’s cap rate with regional or national averages, investors can determine if a property offers a competitive return, considering the associated risk levels.

Comparison Across Different Properties

- Evaluating Diverse Investment Opportunities: Cap rates enable investors to compare the potential profitability and risk of different properties in various locations. For instance, comparing the cap rates of commercial office spaces to retail properties or multi-family units can guide investors on which property type might yield better returns, adjusted for risk.

- Portfolio Diversification: Understanding how cap rates vary across different market segments allows investors to strategize their portfolio diversification. By investing in properties with varying cap rates, they can balance their portfolio’s overall risk and return profile.

- Decision-Making Tool for Buy or Sell Strategies: Cap rates are critical in deciding when to buy or sell a property. For example, an investor might consider selling a property if the cap rate falls significantly, suggesting that the property’s price has increased or its income potential has decreased, making it less lucrative than newer opportunities.

Strategic Implications

- Future Forecasting: Beyond immediate assessment, cap rates forecast future market trends. Investors look at shifts in cap rates over time to predict future movements in the real estate market, which can inform longer-term investment strategies.

- Leveraging for Negotiations: With cap rate data, investors can better negotiate purchase prices and terms. Demonstrating how a property’s cap rate compares to market standards can be a powerful argument in negotiations.

Cap Rates and Market Trends

Understanding the interaction between cap rates and broader real estate market trends is crucial for investors aiming to predict movements in property values and investment returns. This section analyzes the historical evolution of cap rates and explores how they may shift in response to current economic indicators.

Evolution of Cap Rates

- Historical Trends: Over recent years, cap rates have shown significant responsiveness to macroeconomic shifts, such as changes in interest rates, economic growth patterns, and real estate market cycles. For instance, during economic expansion and low-interest rates, cap rates typically compress due to increased demand for real estate investments, driving property values up.

- Impact of Market Conditions: Changes in the real estate market’s supply and demand dynamics influence cap rates. Higher cap rates may be observed in markets with a high supply of properties and lower demand, reflecting increased risk and lower competition for properties.

Predictions Based on Current Economic Indicators

- Economic Indicators: Current economic conditions, including GDP growth rates, employment data, and consumer spending trends, can provide insights into future movements in cap rates. For instance, robust economic growth often leads to lower cap rates as investors are willing to accept lower yields for the perceived lower risk.

- Interest Rates and Inflation: Given the inverse relationship between interest rates and cap rates, rising interest rates could lead to increased cap rates. Similarly, inflationary pressures can impact cap rates by affecting the operating costs associated with properties and tenants’ ability to pay rent.

- Forecasting Models: Using economic forecasting models incorporating these indicators, investors can make educated predictions about where cap rates might head. This forecasting can help decide when to buy or sell properties and adjust investment strategies to align with expected market conditions.

Strategic Use of Cap Rate Trends

- Investment Strategy Adjustments: Investors use insights from analyzing cap rate trends to adjust their investment strategies, such as shifting investments between property types or geographic regions to optimize returns based on expected cap rate movements.

- Risk Management: Understanding potential trends in cap rates also aids in risk management, allowing investors to hedge against potential market downturns or changes in the economic landscape that could unfavorably impact their investments.

Practical Examples of Cap Rate Calculations

Cap rate calculations are crucial for evaluating the profitability and risk of real estate investments. This section provides step-by-step examples using hypothetical property scenarios to illustrate how cap rates are calculated and interpreted.

Example 1: Calculating Cap Rate for a Commercial Office Building

- Scenario: Consider a commercial office building with an annual net operating income (NOI) of $100,000. Its current market value is $1,250,000.

Calculation:

- Cap Rate=(NOI/Property Value)=(100,000/1,250,000 )=8%

- Interpretation: A cap rate of 8% indicates a moderate return on investment. This rate suggests a stable investment with a reasonable risk profile for investors, typically suitable for properties in established markets with consistent demand.

Example 2: Assessing a Multi-Family Residential Complex

- Scenario: A multi-family complex generates an NOI of $150,000 annually, valued at $2,000,000.

- Calculation:

- Cap Rate=(NOI/Property Value)=(150,000/2,000,000)=7.5%

- Interpretation: A cap rate of 7.5% is seen as less attractive in high-growth areas where investors expect higher returns. However, it could be appealing if the property is in a stable area with a low vacancy risk.

Discussion on Interpretation of Cap Rate Results

- High vs. Low Cap Rates: High cap rates generally indicate higher potential returns, often accompanied by higher risk, such as in emerging markets or properties requiring significant management or redevelopment. Low cap rates reflect lower risk and are usually associated with premium properties in prime locations with stable tenant occupancy.

- Implications for Investment Decisions: Investors must balance cap rate findings with other factors like property location, the potential for appreciation, and overall investment strategy. For instance, a lower cap rate in a rapidly appreciating neighborhood might offer more value in the long term than a higher cap rate in a stagnant or declining area.

Challenges in Utilizing Cap Rates

While cap rates are valuable for assessing real estate investments, they have challenges and limitations. Misunderstandings about what cap rates represent and over-reliance on them can lead to misguided investment decisions. This section explores common misconceptions and the inherent limitations of using cap rates as the sole metric for evaluating real estate properties.

Common Misconceptions and Pitfalls

- Misinterpretation of High and Low Cap Rates: A common misconception is that high cap rates always signify better investment opportunities. While a high cap rate may indicate higher potential returns, it often comes with higher risks, such as property obsolescence, undesirable locations, or unstable tenancies. Conversely, a low cap rate does not necessarily imply a bad investment but often reflects lower risk and stable income, typical of prime properties in sought-after locations.

- Overemphasis on Immediate Returns: Cap rates primarily focus on the return for the first year of ownership without considering the future income potential or growth in property value. This can be misleading, especially in markets where property values are rapidly appreciating or in scenarios involving significant future redevelopment and enhancement.

Limitations of Cap Rates as a Sole Metric

- Ignoring Growth Potential: Cap rates do not account for the potential increase in income over time. Properties in developing areas or properties with value-add opportunities may initially show less favorable cap rates. Still, they can offer significant growth potential, which the cap rate alone cannot capture.

- Excluding Financing Costs: Cap rates are calculated independently of financing costs. This can distort the investor’s view, especially when properties are purchased with significant leverage. Considering mortgage payments and financing terms, the actual return on investment might drastically differ from what the cap rate suggests.

- Market Variability: Cap rates vary significantly between markets and even within different segments of the same market. Using a uniform cap rate to compare properties across different regions or sectors can lead to erroneous conclusions if the local market conditions and sector-specific risks are not adequately considered.

Strategic Use of Cap Rates

- Supplementary Analysis: Investors should use cap rates with other financial metrics, such as cash-on-cash returns, internal rate of return (IRR), and total return on investment, to get a comprehensive view of a property’s profitability and risk profile.

- Contextual Evaluation: Understanding the specific circumstances and market conditions that influence cap rates is crucial. To contextualize the cap rate findings, investors should consider economic forecasts, market trends, and sector-specific dynamics as part of their investment analysis.

Advanced Considerations in Cap Rate Analysis

Cap rate analysis is not just a preliminary screening tool but a part of a sophisticated investment decision-making process. Experienced investors often adjust cap rate calculations and interpretations to align with nuanced investment strategies and broader economic indicators. This section delves into how these advanced considerations can significantly influence investment outcomes.

Adjusting Cap Rate Calculations

- Risk-Adjusted Cap Rates: Seasoned investors often modify cap rates based on perceived risk levels associated with specific properties or markets. For instance, a premium might be added to the cap rate for properties in volatile markets or those with less reliable income streams, thereby adjusting expected returns for higher perceived risks.

- Future Income Projections: Instead of solely focusing on current NOI, sophisticated investors project future NOI based on expected economic and market developments. Adjustments are made for anticipated changes in rental income, property operating costs, and local market conditions, providing a dynamic view of the property’s profitability.

- Comparative Market Analysis: Advanced investors use cap rates with comparative market analyses. This involves examining cap rates of similar properties in similar locations and conditions, adjusted for unique property features or strategic positioning, to gauge market competitiveness and investment attractiveness.

Considering External Economic Factors

- GDP Growth Rates: Economic growth indicators such as GDP growth rates can provide insights into future property demand and rental income potential. Properties in high-growth economies might justify lower initial cap rates due to their higher future income potentials.

- Unemployment Levels: An area’s overall employment situation can affect tenant stability and, consequently, the reliability of NOI. Higher unemployment levels might necessitate higher cap rates to compensate for the increased risk of tenant defaults.

- Interest Rate Forecasts: Interest rates directly impact property investment decisions. Expected increases in interest rates might lead investors to demand higher cap rates to offset the higher borrowing costs and reduced property affordability. In contrast, stable or decreasing rates justify lower cap rates.

Strategic Implications

- Investment Timing and Exit Strategies: By incorporating forward-looking economic data and adjusting cap rates accordingly, investors can better time their entry and exit from investments to maximize returns and minimize risks.

- Portfolio Diversification: Advanced cap rate analysis helps investors identify opportunities for portfolio diversification across geographies, property types, and tenant industries, aligning investment risks with broader economic cycles.

Conclusion

Cap rates are an indispensable tool in the arsenal of real estate investment, providing a quick and effective method to assess the potential return on investment for various properties. Throughout this discussion, we have explored the fundamental aspects of cap rates, from their basic calculation methods to the factors influencing their variations. We’ve also examined the practical applications of cap rates in investment decision-making, highlighting how they can signal opportunities and risks within the real estate market.

Understanding cap rates is crucial for gauging current value and returns, strategic planning, and forecasting future market trends. Investors can use cap rates to make informed decisions that align with their financial goals and risk tolerance by considering internal factors like property conditions and external economic indicators.

Call to Action

A deeper understanding of cap rates is essential for potential investors and real estate professionals to navigate the complexities of the real estate market effectively. Please continue exploring this topic through further education and consultation with experienced real estate analysts and advisors. By enhancing your understanding of cap rates and how they can be adjusted and interpreted in various scenarios, you will be better equipped to identify valuable investment opportunities and develop robust investment strategies.

Investing in real estate is a substantial commitment that benefits significantly from informed decision-making supported by reliable data and expert insights. Engage with professionals who can provide the latest market analyses and help you understand the nuances of cap rates about your specific investment interests.

Mortgage rates

| ||||||||||||||||||||||||||||||||||||

- 1031 Exchanges in Commercial Real Estate: Strategies, Benefits, and Challenges

- A Comprehensive Guide to Commercial Property Insurance

- About

- Achieving High Performance in Commercial Real Estate Operations

- Adaptive Strategies for Commercial Real Estate Success Amid Economic Uncertainty

- Amortization in Commercial Real Estate Lending

- Apartments

- Are Commercial Real Estate Loans Fixed or Variable?

- Bad Boy Carve-Outs in Commercial Real Estate Loans

- Beyond the Lease: Cultivating Enduring Tenant Relationships in Commercial Real Estate

- Blend and Extend Agreements: An Overview

- Blog

- Breakeven Occupancy

- bridge Loans

- Class A Offices: The Pinnacle of Commercial Real Estate

- Commercial Bridge Loans: A Strategic Guide for Real Estate Investors

- Commercial Development Finance: Key Strategies and Insights for Successful Property Projects

- Commercial Hard Money Bridge Loans

- Commercial Lease Escalation Clause

- Commercial Loan Defaults

- Commercial Lockout: Understanding Legalities and Procedures in Texas Real Estate

- Commercial Mortgage Calculator

- Commercial Mortgage-Backed Securities (CMBS) Loans

- Commercial Property Improvement Loan

- Commercial Property Management: A Comprehensive Guide

- Commercial Real Estate Appraisal: A Comprehensive Guide

- Commercial Real Estate Debt Funds: A Detailed Overview

- Commercial Real Estate Underwriting: Key Metrics, Processes, and Technological Integration

- Commercial Real Estate Valuation Models

- Commercial Real Estate: The Benefits of Long-term Investment

- Commercial Real-Estate Finance Brokers

- Commercial Zoning in Real Estate: A Comprehensive Guide

- Compound Interest Real Estate

- Conditional Use Real Estate: Permits, Compliance, and Development Opportunities

- Contact Us

- Defeasing in Commercial Real Estate: Benefits, Process, and Financial Flexibility

- Double Net Lease Explained: Benefits, Responsibilities, and Strategic Insights

- E-Commerce's Profound Impact on Commercial and Industrial Real Estate

- Emerging Technologies Impacting Commercial Real Estate

- Essential Steps for Successful Due Diligence in Commercial Property Investment

- Exit Strategies for Commercial Real Estate Investors

- Exploring Commercial Equity and Equity Participation Loans

- Exploring Commercial Real Estate Marketing Strategies

- Exploring Securitization in Commercial Real Estate: A Comprehensive Overview

- Exploring Submarkets in Real Estate: Identifying Opportunities and Achieving Growth

- Fixed Interest Rates: Stability, Benefits, and Strategic Financial Planning

- Florida Commercial Hard Money Loans

- Greening the Urban Jungle: The Rise of Sustainable Buildings in Commercial Real Estate

- Gross Potential Income (GPI) in Real Estate

- Hill Creek Commercial Capital

- Historic Tax Credits (HTC) in Real Estate Development

- Hospitality Loans: Flexible Financing for Hotel Acquisition, Renovation, and Expansion

- Hotel Loans

- Houston Commercial Hard Money Loans

- How Demographic Trends Shaping Commercial Real Estate

- How the Prime Rate Impacts Real Estate Loans and Investments in 2024

- Impact of Rising Interest Rates on Commercial Real Estate

- industrial

- Investing in Health: The Unyielding Appeal of Medical Office Real Estate

- Land Loans

- Land Use Restrictive Agreements (LURA): Ensuring Long-Term Affordable Housing Stability

- Launching Your Journey in Commercial Real Estate Investment: A Beginner's Blueprint

- Lease Assignment Explained: Key Steps, Benefits, and Potential Risks in Transferring Lease Rights

- Lease-Up Loans: Essential Financing for New Multifamily Properties

- Leveraging Opportunities in Distressed Commercial Real Estate

- Life Company Loans

- Liquidity in Commercial Real Estate Markets

- Loan Holdback

- Loan Quote

- Loan types

- Low-Income Housing Tax Credit

- Mastering Commercial Real Estate Development

- Mastering Credit Risk Analysis in Commercial Real Estate Lending

- Mastering Debt Constant: A Key Metric for Loan Assessment and Financial Decision-Making

- Mastering Real Estate Market Analysis: A Guide for Investors

- Mastering the Art of Commercial Lease Negotiation

- Mastering the Art of Refinancing Commercial Real Estate Loans

- Maximizing Profits In Commercial Real Estate Through Effective Leasing Strategies

- Maximizing Profits Through Strategic Real Estate Asset Management

- Maximizing Property Value with HUD Refinancing: Benefits, Eligibility, and Process

- Maximizing Rental Property Investment with SBA 504 Loans: Benefits and Eligibility Criteria

- Maximizing Returns in Real Estate: The Strategic Approach of CRE Multifamily in the Evolving Market

- Maximizing Returns: The Tax Advantages of Commercial Real Estate Investment

- Miami Commercial Hard Money Loans

- mortgage rates

- New York Commercial Hard Money Loans

- Office

- Office Real Estate Investment: Key Factors, Strategies, and Market Insights for Success

- Opportunity Zone Loans: Maximizing Tax Benefits and Investment Potential

- Optimizing Real Estate Investments: Key Structures and Strategies for Successful Partnerships

- Pari Passu in Real Estate: Ensuring Fair and Equitable Investment Strategies

- Permanant Financing

- Physical Vs. Economic Occupancy: A Comprehensive Analysis

- Portfolio Diversification with Commercial Real Estate

- Preparing for the Future: Commercial Real Estate and Climate Change

- Prepayment Penalties in Commercial Real Estate Financing

- Privacy Policy

- Promoted Structure in Commercial Real Estate: Aligning Interests and Maximizing Returns

- Real Estate Joint Ventures: Strategies, Structures, and Key Considerations

- Recourse and Non-Recourse Financing in Commercial Real Estate

- REITs vs. Direct Investment in Commercial Real Estate: Comparing investment vehicles and their implications

- Restaurant Financing: An Essential Guide for Culinary Ventures

- Retail

- Revitalizing Commercial Real Estate: A Guide to Enhancing Value in the Digital Era

- Revolutionizing the Secondary CRE Market: Unleashing Potential Amid Change

- Sale Leaseback Commercial Real Estate

- SBA 504

- SBA 7A

- Self-storage financing

- SOFR in Real Estate: Understanding the Transition from LIBOR and Its Industry Implications

- Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

- ssuming SBA Loans: Conditions, Benefits, and Risks Explained

- Texas Commercial Hard Money Loans

- The Complexities of Commercial Real Estate Syndication and Syndicated Loans

- the Due Diligence Process in Commercial Real Estate Investments

- The Regulatory Terrain: Mastering Real Estate Development and Investment in Today's World

- The Rise of Mixed-Use Developments in Urban Commercial Real Estate

- Thriving in Downturns: The Counterintuitive Appeal of Commercial Real Estate Investment During Recessions

- Transforming Spaces: The Evolution of Office Real Estate in a Post-COVID World

- Transforming Urban Landscapes through Commercial Real Estate Repurposing

- Understanding Anchor Tenants: Key Benefits and Strategies for Commercial Real Estate Success

- Understanding Base Year Stop in Commercial Leases: Benefits, Risks, and Cost Management

- Understanding BOMA Standards in Real Estate: Accurate Measurements and Enhanced Leasing Strategies

- Understanding CAM Charges in Commercial Real Estate

- Understanding Cap Rates in Commercial Real Estate Investment

- Understanding Commercial Loan Origination Fees in Real Estate

- Understanding Debt Service Coverage Ratio (DSCR) in Real Estate Investing

- Understanding Debt Yield in Commercial Real Estate Finance

- Understanding Fixed vs. Variable Interest Rates in Finance

- Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

- Understanding Ground Leases in Commercial Real Estate

- Understanding Load Factor in Real Estate: Impact on Leasing and Space Utilization

- Understanding Mezzanine Financing in Real Estate: Balancing Risk and Reward for Optimal Investment

- Understanding NPV in Real Estate: Calculating Profitability and Making Informed Investment Decisions

- Understanding Preferred Equity: Balancing Risk and Reward in Your Investment Portfolio

- Understanding Real Estate Limited Partnerships (RELPs): Benefits, Structure, and Investment Potentia

- Understanding Recapture Clauses in Commercial Leases: Benefits and Implementation Strategies

- Understanding Rent Ceilings: Balancing Affordability and Landlord Interests in Housing Policy

- Understanding the 2% Rule in Real Estate Investing: Maximizing Profitability and Cash Flow

- Unlocking Opportunities: A Deep Dive into Real Estate Crowdfunding Introduction

- Unlocking the Potential of Infill Real Estate: Strategies for Sustainable Urban Development

- Unlocking the Potential of Shadow Space: Strategies for Maximizing Real Estate Profitability

- Unveiling the Economic Titan: The Role of Commercial Real Estate

- We are negotiating Commercial Real Estate Deals: Techniques and tips for effective negotiation.

- What Is a Balloon Payment on a Commercial Loan

- What Is a Power Center in Real Estate?

- What Is Impact Investing in Commercial Real Estate

- Working from home May Adapt to Office Real Estate