In This Article

- Key Takeaways

- Importance of GRM in Real Estate Investment

- What is Gross Rent Multiplier?

- How to Calculate GRM

- What is a Good GRM?

- Using GRM in Real Estate Investment

- Comparing GRM with Cap Rate and Net Operating Income (NOI)

- Examples of Adjusting Investment Strategy Based on GRM Findings

- Frequently Asked Questions

- Conclusion

- Get A Loan Quote Now!

Call or Email Us at

713-331-9463

info@hillcreekcommercialcapital.com

Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

Definition of Gross Rent Multiplier (GRM)

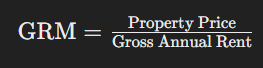

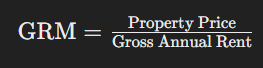

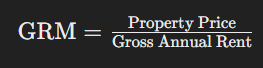

The Gross Rent Multiplier (GRM) is a simple valuation metric used by real estate investors to assess the profitability of a rental property. It is calculated by dividing the property’s purchase price by its gross annual rental income. The formula is expressed as:

This ratio indicates the number of years it would take for an investor to recoup the purchase price of a property based on its rental income, assuming no operating expenses or vacancies.

Key Takeaways

- Quick Profitability Metric: GRM provides a fast way to assess a rental property’s profitability based on purchase price and gross rental income.

- Initial Screening Tool: It helps investors quickly compare properties and filter out those that don’t meet their criteria.

- Market Insights: GRM aids in understanding market conditions, with lower GRM values indicating potentially faster returns.

- Simplified Analysis: GRM is easy to calculate but doesn’t consider expenses, vacancies, or financing costs.

- Supplementary Metric: Use GRM alongside other metrics like Cap Rate and NOI for a thorough evaluation.

- Strategic Application: Investors can adjust their strategies based on GRM findings, optimizing their portfolios for balanced returns.

Importance of GRM in Real Estate Investment

GRM is a crucial tool for real estate investors for several reasons:

1. Quick Comparison: It allows investors to quickly compare the profitability of multiple properties without delving into complex financial details. By providing a straightforward metric, GRM helps in making preliminary assessments.

2. Market Analysis: GRM helps investors understand different areas’ market conditions and property values. A lower GRM often indicates a property that can generate rental income faster relative to its price, making it more attractive in high-demand rental markets.

3. Investment Screening: Investors use GRM as an initial screening tool to filter out properties that do not meet their investment criteria. This saves time and resources by focusing only on the most promising opportunities.

4. Financial Planning: GRM provides a clear picture of the potential return on investment (ROI). By knowing how long it will take to recoup the investment, investors can make informed decisions about financing, cash flow management, and long-term profitability.

What is Gross Rent Multiplier?

The Gross Rent Multiplier (GRM) is a straightforward financial metric used by real estate investors to evaluate the potential profitability of rental properties. It represents the ratio between a property’s purchase price and its gross annual rental income. By providing a quick snapshot of the property’s income-generating potential, GRM helps investors make preliminary assessments about the property’s value and profitability.

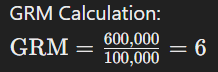

Formula: GRM = Property Price / Gross Annual Rent

The formula for calculating the Gross Rent Multiplier is:

This formula illustrates how long it would take for an investor to recoup the property’s purchase price through its rental income, assuming no expenses or vacancies.

How GRM Helps in Evaluating Investment Properties

GRM is a valuable tool for investors in several ways:

1. Initial Screening: GRM provides a quick and easy method for comparing multiple properties based on their income potential. Properties with lower GRM values are generally more attractive because they indicate a faster return on investment.

2. Market Insight: GRM helps investors understand the relative value of properties in different markets. By comparing GRMs across similar properties, investors can identify which markets offer better investment opportunities.

3. Simplified Analysis: GRM simplifies evaluating investment properties by focusing solely on purchase price and gross rental income. This lets investors make quick decisions without getting bogged down in detailed financial analysis.

4. Benchmarking: Investors can use GRM as a benchmark to set their investment criteria. For instance, an investor might decide only to consider properties with a GRM below a certain threshold, ensuring they focus on properties that meet their income requirements.

Examples of GRM Calculation

To illustrate how GRM is calculated, let’s look at a few examples:

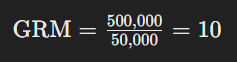

1. Example 1:

– Property Price: $500,000

– Gross Annual Rent: $50,000

– GRM Calculation:

This means the rental income would take ten years to equal the purchase price.

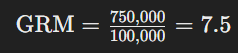

Example 2:

– Property Price: $750,000

– Gross Annual Rent: $100,000

– GRM Calculation:

In this case, the rental income would take 7.5 years to equal the purchase price.

Example 3:

– Property Price: $300,000

– Gross Annual Rent: $30,000

– GRM Calculation:

Similar to Example 1, this property has a GRM of 10, indicating a 10-year payback period based on gross rental income.

By understanding and applying the GRM, real estate investors can make more informed decisions about which properties to invest in and how to structure their investment strategies for optimal returns.

How to Calculate GRM

Step-by-step Guide to Calculating GRM

Calculating the Gross Rent Multiplier (GRM) is a simple process involving two critical pieces of information: the property’s purchase price and gross annual rental income. Here’s a step-by-step guide:

1. Determine the Property Price: Find out the property’s total purchase price. This includes the cost of the property itself and any additional fees associated with the purchase, such as closing costs.

2. Calculate the Gross Annual Rent: The property’s total annual rental income is the sum of all the rent collected from tenants over a year.

3. Apply the GRM Formula:

Example Calculation:

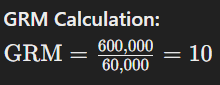

Property Price: $600,000

Gross Annual Rent: $60,000

RM Calculation:

This means the rental income would take ten years to equal the purchase price.

Tools and Methods for Accurate Calculation

While calculating GRM can be done manually using the formula, several tools and methods can help ensure accuracy and efficiency:

1. Online Calculators: Many real estate websites offer online GRM calculators. These tools allow you to automatically input the property price and annual rent to calculate the GRM.

2. Spreadsheet Software: Spreadsheet software like Microsoft Excel or Google Sheets can simplify the calculation. You can set up a basic formula to compute GRM for multiple properties simultaneously, which helps compare several investment opportunities.

3. Real Estate Software: Professional real estate software often includes GRM calculation features and other financial analysis tools. These programs can provide comprehensive property evaluations.

4. Financial Apps: Mobile apps designed for real estate investors often include GRM calculators. These apps are convenient for on-the-go calculations and quick assessments.

Importance of Using Accurate Property Price and Rental Income Figures

Accurate data is crucial for reliable GRM calculations. Here’s why:

1. Precision in Investment Analysis: Inaccurate property prices or rental income figures can lead to misleading GRM values, affecting investment decisions. Ensure you have the correct purchase price, including all associated costs.

2. Better Market Comparisons: Reliable GRM calculations allow more accurate comparisons between properties and markets, helping identify the best investment opportunities.

3. Informed Financial Planning: Accurate figures enable better financial planning and forecasting. Knowing the true GRM helps estimate how quickly an investment will pay off and its long-term profitability.

4. Avoiding Overvaluation: Inflated or incorrect figures can overestimate a property’s value and potential returns, leading to poor investment choices and financial losses.

In summary, calculating the GRM involves:

- Determining the property price and gross annual rent.

- Applying the GRM formula.

- Using tools for accuracy.

Ensuring the accuracy of these figures is essential for making informed, reliable investment decisions.

What is a Good GRM?

Ideal Range for GRM

The ideal Gross Rent Multiplier (GRM) range typically falls between 4 and 7. Properties within this range generally offer a balanced return on investment. However, the ideal GRM can vary based on several factors, including market conditions, property type, and location.

Factors Influencing a Good GRM

Several factors can influence a good GRM for a particular property or market. Understanding these factors helps investors make more informed decisions.

1. Market Conditions: Local Market Dynamics:

Local real estate market conditions significantly impact GRM. In hot markets with high demand and low supply, increased property prices may raise GRM values.

Economic Trends: Broader economic factors such as interest rates, employment rates, and economic growth can influence rental income and property values, thereby affecting GRM.

2. Property Type and Location:

Residential vs. Commercial Properties: Different property types can have different GRM ranges. Residential properties typically have lower GGRMs than commercial properties due to differences in rental income stability and tenant turnover.

Location: Properties in prime locations or high-demand areas often have higher GRMs. For example, urban properties usually command higher rental income, leading to higher GRM values than rural or suburban properties.

Examples of Different GRM Values and Their Implications

Understanding the implications of different GRM values helps investors gauge the attractiveness of various investment opportunities.

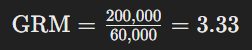

1. Low GRM (Below 4):

Implication: A low GRM indicates that a property generates high rental income relative to its price. This can be an attractive investment as it suggests a quicker payback period.

Example: A property priced at $200,000 with an annual rental income of $60,000 has a GRM of:

Interpretation: The low GRM suggests solid rental income, making it a potentially lucrative investment. However, further investigation may also be warranted into why the property is priced relatively low.

2. Ideal GRM (Between 4 and 7):

Implication: This range is often considered a balanced investment, indicating a reasonable relationship between the purchase price and rental income.

Example: A property priced at $500,000 with an annual rental income of $100,000 has a GRM of:

Interpretation: A GRM of 5 suggests a good balance and reasonable expectation of return on investment over time.

3. High GRM (Above 7):

Implication: A high GRM indicates that the property generates lower rental income relative to its price. This could be less attractive due to a more extended payback period.

Example: A property priced at $800,000 with an annual rental income of $80,000 has a GRM of:

Interpretation: The high GRM suggests it will take longer to recoup the investment through rental income, which may indicate overpricing or lower rental yield.

A good GRM typically ranges between 4 and 7 depending on market conditions, property type, and location. Investors should consider these factors and understand the implications of different GRM values to make informed real estate investment decisions.

Using GRM in Real Estate Investment

How Investors Use GRM to Compare Properties

Investors use the Gross Rent Multiplier (GRM) as a quick and straightforward metric to compare the profitability of different rental properties. By focusing solely on the purchase price and gross annual rental income, GRM provides a preliminary assessment of how long it would take for an investment to pay off based on rental income alone. This allows investors to:

1. Identify Potential Investments: Quickly evaluate and rank properties to determine which ones merit further investigation.

2. Benchmark Against Market Averages: Compare properties against the area’s average GRM values to gauge whether a property is under or overvalued.

3. Assess Relative Value: Use GRM to assess the relative value of properties in different locations or with other property types.

GRM as a Screening Tool for Initial Property Assessment

GRM is particularly useful as an initial screening tool for real estate investments. Here’s how it works:

1. Rapid Evaluation: Investors can quickly weed out properties that do not meet their investment criteria. For instance, if an investor is targeting properties with a GRM of less than 6, they can immediately exclude those with higher GRMs from further consideration.

2. Focus on High-Potential Properties: By narrowing down the list of properties based on GRM, investors can spend more time and resources analyzing the most promising opportunities in greater detail.

3. Preliminary Financial Assessment: GRM provides a quick snapshot of a property’s financial potential, allowing investors to make informed decisions early in the investment process.

Limitations of GRM: Does Not Consider Operating Expenses, Vacancies, and Other Costs

While GRM is a valuable metric, it has several limitations:

1. Excludes Operating Expenses: GRM does not account for operating expenses such as maintenance, property management fees, taxes, and insurance, which can significantly impact a rental property’s profitability.

2. Ignores Vacancies: The formula assumes full occupancy and does not consider potential vacancies, which can affect rental income.

3. No Consideration of Financing Costs: GRM does not consider financing costs such as mortgage interest, which can affect cash flow and profitability.

4. Simplistic Approach: GRM is a simplistic metric that only provides a rough estimate of profitability. It does not provide a comprehensive analysis of a property’s financial performance.

Comparing GRM with Cap Rate and Net Operating Income (NOI)

To gain a more comprehensive understanding of a property’s financial potential, investors often compare GRM with other metrics such as Cap Rate and Net Operating Income (NOI):

1. Cap Rate (Capitalization Rate):

Explanation: The Cap Rate measures the rate of return on a real estate investment based on the income the property is expected to generate. It provides a more detailed analysis by considering operating expenses.

Comparison with GRM: While GRM focuses on gross income, the Cap Rate provides a net measure of profitability, making it more comprehensive. A lower Cap Rate indicates a lower risk and a higher potential return, while a higher Cap Rate indicates a higher risk and potential for higher returns.

2. Net Operating Income (NOI):

Explanation: NOI represents a property’s total income after deducting operating expenses but before accounting for taxes and financing costs. It is a crucial metric for assessing a property’s profitability.

Comparison with GRM: NOI provides a more detailed financial picture than GRM by factoring in expenses. It helps investors understand the actual cash flow generated by a property.

While GRM is a valuable initial screening tool for real estate investments, it has limitations. Investors should use it with other metrics like Cap Rate and NOI to comprehensively understand a property’s financial potential. This multi-metric approach allows for more informed and strategic investment decisions.

Practical Applications of GRM

Case Studies of Properties with Different GRM Values

Case Study 1: Low GRM Property

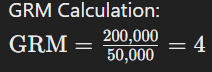

Property Details:

– Location: Suburban area

– Purchase Price: $200,000

– Gross Annual Rent: $50,000

– GRM Calculation:

A GRM of 4 indicates that the property’s rental income is relatively high compared to its purchase price. This property offers a quick payback period, making it an attractive investment. The low GRM suggests strong rental demand or undervaluation, warranting further investigation into the local rental market and property condition.

Case Study 2: Ideal GRM Property

Property Details:

– Location: Urban center

– Purchase Price: $600,000

– Gross Annual Rent: $100,000

A GRM of 6 is within the ideal range for many investors. It suggests a balanced investment where the property’s income potential aligns well with its purchase price. This GRM is often seen in stable markets with moderate appreciation potential, making it a solid, long-term investment.

Case Study 3: High GRM Property

Property Details

– Location: High-demand urban area

– Purchase Price: $1,200,000

– Gross Annual Rent: $120,000

A GRM of 10 indicates a longer payback period, suggesting the property is expensive relative to its rental income. This may be typical in high-demand areas where factors beyond rental income, such as the potential for significant appreciation or development opportunities, drive property values.

Using GRM to Estimate Property Value and Rental Income

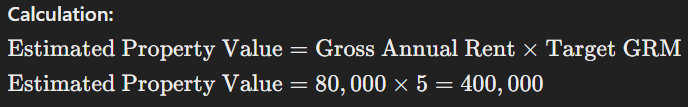

Estimating Property Value:

Scenario:

- An investor is looking at a rental property that generates $80,000 in annual rental income.

- The investor’s target GRM is 5.

Based on their target GRM of 5, the investor should be willing to pay up to $400,000 for the property.

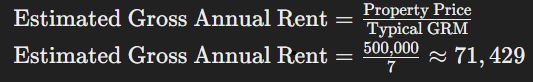

Estimating Rental Income:

Scenario:

– An investor is considering a property priced at $500,000.

– The typical GRM in the area is 7.

The investor can expect to generate approximately $71,429 in annual rental income from the property.

Examples of Adjusting Investment Strategy Based on GRM Findings

Adjusting for Low GRM:

Scenario:

An investor finds a property with a GRM of 3.5.

Strategy:

- The low GRM indicates high rental income relative to the purchase price. The investor might:

- Increase their investment in similar properties in the area.

- Conduct due diligence to ensure no hidden issues (e.g., maintenance costs or high tenant turnover).

- Consider leveraging the property’s cash flow to finance additional investments.

Adjusting for High GRM:

Scenario:

An investor is evaluating a property with a GRM of 11.

Strategy:

- The high GRM suggests a longer payback period. The investor might:

- Look for properties with lower GRMs to ensure quicker returns.

- Negotiate a lower purchase price to bring the GRM down.

- Evaluate the potential for property value appreciation to justify the higher GRM.

- Assess the possibility of increasing rental income through improvements or better property management.

Balancing Portfolio with Ideal GRM:

Scenario:

An investor’s portfolio has properties with varying GRMs, from 3 to 11.

Strategy:

- Investors might aim to balance their portfolio by acquiring properties with GRMs in the ideal range (4-7) to stabilize returns.

- Diversifying property types and locations to manage risk and optimize portfolio performance.

GRM is a practical tool for real estate investors to assess and compare properties quickly, estimate property values and rental incomes, and adjust investment strategies based on preliminary financial insights. By understanding the implications of different GRM values and incorporating them into broader financial analyses, investors can make more informed and strategic decisions.

Frequently Asked Questions

What is Gross Rent Multiplier (GRM)?

Answer: GRM is a simple financial metric used in real estate to assess the profitability of a rental property. It is calculated by dividing the property’s purchase price by its gross annual rental income.

How is GRM calculated?

Answer: GRM is calculated using the formula GRM = Property Price / Gross Annual Rent. This indicates the number of years it would take to recoup the property’s purchase price through rental income, assuming no operating expenses or vacancies.

Why is GRM important in real estate investment?

Answer: GRM is essential because it provides a quick way to compare the profitability of different rental properties without needing detailed financial analysis. It’s useful for initial screening, market analysis, and setting investment benchmarks.

What is a good GRM value?

Answer: A good GRM typically ranges between 4 and 7, depending on the market, property type, and location. Lower GRMs suggest quicker returns, while higher GRMs indicate a longer payback period.

Can GRM be used for all property types?

Answer: Yes, GRM can be used for both residential and commercial properties, but it’s essential to consider that different property types may have different typical GRM ranges.

What are the limitations of using GRM?

Answer: GRM doesn’t account for operating expenses, vacancies, or financing costs, making it a less comprehensive metric. For a fuller financial picture, it should be used alongside other metrics like Cap Rate and Net Operating Income (NOI).

How does GRM compare to Cap Rate and NOI?

Answer: GRM focuses on the relationship between the purchase price and gross rental income, the Cap Rate considers net income after expenses, and NOI measures income after operating expenses. Together, these metrics provide a more complete analysis of a property’s financial performance.

How can I use GRM in my investment strategy?

Answer: GRM can assess potential investments quickly, set benchmarks for acceptable properties, and compare different markets. Investors often adjust their strategies based on GRM findings to optimize portfolio returns.

Conclusion

The Gross Rent Multiplier (GRM) is a vital tool in the initial assessment of real estate investments, providing investors with a quick and straightforward method to gauge the potential profitability of rental properties. While GRM allows for rapid comparisons and preliminary financial insights, it is essential to recognize its limitations, particularly its exclusion of operating expenses, vacancies, and financing costs. For a more comprehensive evaluation, GRM should be used in conjunction with other metrics like Cap Rate and Net Operating Income (NOI). By understanding the nuances of GRM and applying it appropriately, investors can make informed decisions, refine their investment strategies, and better align their property portfolios with their financial goals.

Mortgage rates

| ||||||||||||||||||||||||||||||||||||

- 1031 Exchanges in Commercial Real Estate: Strategies, Benefits, and Challenges

- A Comprehensive Guide to Commercial Property Insurance

- About

- Achieving High Performance in Commercial Real Estate Operations

- Adaptive Strategies for Commercial Real Estate Success Amid Economic Uncertainty

- Amortization in Commercial Real Estate Lending

- Apartments

- Are Commercial Real Estate Loans Fixed or Variable?

- Bad Boy Carve-Outs in Commercial Real Estate Loans

- Beyond the Lease: Cultivating Enduring Tenant Relationships in Commercial Real Estate

- Blend and Extend Agreements: An Overview

- Blog

- Breakeven Occupancy

- bridge Loans

- Class A Offices: The Pinnacle of Commercial Real Estate

- Commercial Bridge Loans: A Strategic Guide for Real Estate Investors

- Commercial Development Finance: Key Strategies and Insights for Successful Property Projects

- Commercial Hard Money Bridge Loans

- Commercial Lease Escalation Clause

- Commercial Loan Defaults

- Commercial Lockout: Understanding Legalities and Procedures in Texas Real Estate

- Commercial Mortgage Calculator

- Commercial Mortgage-Backed Securities (CMBS) Loans

- Commercial Property Improvement Loan

- Commercial Property Management: A Comprehensive Guide

- Commercial Real Estate Appraisal: A Comprehensive Guide

- Commercial Real Estate Debt Funds: A Detailed Overview

- Commercial Real Estate Underwriting: Key Metrics, Processes, and Technological Integration

- Commercial Real Estate Valuation Models

- Commercial Real Estate: The Benefits of Long-term Investment

- Commercial Real-Estate Finance Brokers

- Commercial Zoning in Real Estate: A Comprehensive Guide

- Compound Interest Real Estate

- Conditional Use Real Estate: Permits, Compliance, and Development Opportunities

- Contact Us

- Defeasing in Commercial Real Estate: Benefits, Process, and Financial Flexibility

- Double Net Lease Explained: Benefits, Responsibilities, and Strategic Insights

- E-Commerce's Profound Impact on Commercial and Industrial Real Estate

- Emerging Technologies Impacting Commercial Real Estate

- Essential Steps for Successful Due Diligence in Commercial Property Investment

- Exit Strategies for Commercial Real Estate Investors

- Exploring Commercial Equity and Equity Participation Loans

- Exploring Commercial Real Estate Marketing Strategies

- Exploring Securitization in Commercial Real Estate: A Comprehensive Overview

- Exploring Submarkets in Real Estate: Identifying Opportunities and Achieving Growth

- Fixed Interest Rates: Stability, Benefits, and Strategic Financial Planning

- Florida Commercial Hard Money Loans

- Greening the Urban Jungle: The Rise of Sustainable Buildings in Commercial Real Estate

- Gross Potential Income (GPI) in Real Estate

- Hill Creek Commercial Capital

- Historic Tax Credits (HTC) in Real Estate Development

- Hospitality Loans: Flexible Financing for Hotel Acquisition, Renovation, and Expansion

- Hotel Loans

- Houston Commercial Hard Money Loans

- How Demographic Trends Shaping Commercial Real Estate

- How the Prime Rate Impacts Real Estate Loans and Investments in 2024

- Impact of Rising Interest Rates on Commercial Real Estate

- industrial

- Investing in Health: The Unyielding Appeal of Medical Office Real Estate

- Land Loans

- Land Use Restrictive Agreements (LURA): Ensuring Long-Term Affordable Housing Stability

- Launching Your Journey in Commercial Real Estate Investment: A Beginner's Blueprint

- Lease Assignment Explained: Key Steps, Benefits, and Potential Risks in Transferring Lease Rights

- Lease-Up Loans: Essential Financing for New Multifamily Properties

- Leveraging Opportunities in Distressed Commercial Real Estate

- Life Company Loans

- Liquidity in Commercial Real Estate Markets

- Loan Holdback

- Loan Quote

- Loan types

- Low-Income Housing Tax Credit

- Mastering Commercial Real Estate Development

- Mastering Credit Risk Analysis in Commercial Real Estate Lending

- Mastering Debt Constant: A Key Metric for Loan Assessment and Financial Decision-Making

- Mastering Real Estate Market Analysis: A Guide for Investors

- Mastering the Art of Commercial Lease Negotiation

- Mastering the Art of Refinancing Commercial Real Estate Loans

- Maximizing Profits In Commercial Real Estate Through Effective Leasing Strategies

- Maximizing Profits Through Strategic Real Estate Asset Management

- Maximizing Property Value with HUD Refinancing: Benefits, Eligibility, and Process

- Maximizing Rental Property Investment with SBA 504 Loans: Benefits and Eligibility Criteria

- Maximizing Returns in Real Estate: The Strategic Approach of CRE Multifamily in the Evolving Market

- Maximizing Returns: The Tax Advantages of Commercial Real Estate Investment

- Miami Commercial Hard Money Loans

- mortgage rates

- New York Commercial Hard Money Loans

- Office

- Office Real Estate Investment: Key Factors, Strategies, and Market Insights for Success

- Opportunity Zone Loans: Maximizing Tax Benefits and Investment Potential

- Optimizing Real Estate Investments: Key Structures and Strategies for Successful Partnerships

- Pari Passu in Real Estate: Ensuring Fair and Equitable Investment Strategies

- Permanant Financing

- Physical Vs. Economic Occupancy: A Comprehensive Analysis

- Portfolio Diversification with Commercial Real Estate

- Preparing for the Future: Commercial Real Estate and Climate Change

- Prepayment Penalties in Commercial Real Estate Financing

- Privacy Policy

- Promoted Structure in Commercial Real Estate: Aligning Interests and Maximizing Returns

- Real Estate Joint Ventures: Strategies, Structures, and Key Considerations

- Recourse and Non-Recourse Financing in Commercial Real Estate

- REITs vs. Direct Investment in Commercial Real Estate: Comparing investment vehicles and their implications

- Restaurant Financing: An Essential Guide for Culinary Ventures

- Retail

- Revitalizing Commercial Real Estate: A Guide to Enhancing Value in the Digital Era

- Revolutionizing the Secondary CRE Market: Unleashing Potential Amid Change

- Sale Leaseback Commercial Real Estate

- SBA 504

- SBA 7A

- Self-storage financing

- SOFR in Real Estate: Understanding the Transition from LIBOR and Its Industry Implications

- Sources and Uses in Real Estate: Essential Financial Planning for Successful Investments

- ssuming SBA Loans: Conditions, Benefits, and Risks Explained

- Texas Commercial Hard Money Loans

- The Complexities of Commercial Real Estate Syndication and Syndicated Loans

- the Due Diligence Process in Commercial Real Estate Investments

- The Regulatory Terrain: Mastering Real Estate Development and Investment in Today's World

- The Rise of Mixed-Use Developments in Urban Commercial Real Estate

- Thriving in Downturns: The Counterintuitive Appeal of Commercial Real Estate Investment During Recessions

- Transforming Spaces: The Evolution of Office Real Estate in a Post-COVID World

- Transforming Urban Landscapes through Commercial Real Estate Repurposing

- Understanding Anchor Tenants: Key Benefits and Strategies for Commercial Real Estate Success

- Understanding Base Year Stop in Commercial Leases: Benefits, Risks, and Cost Management

- Understanding BOMA Standards in Real Estate: Accurate Measurements and Enhanced Leasing Strategies

- Understanding CAM Charges in Commercial Real Estate

- Understanding Cap Rates in Commercial Real Estate Investment

- Understanding Commercial Loan Origination Fees in Real Estate

- Understanding Debt Service Coverage Ratio (DSCR) in Real Estate Investing

- Understanding Debt Yield in Commercial Real Estate Finance

- Understanding Fixed vs. Variable Interest Rates in Finance

- Understanding Gross Rent Multiplier (GRM) in Real Estate Investment

- Understanding Ground Leases in Commercial Real Estate

- Understanding Load Factor in Real Estate: Impact on Leasing and Space Utilization

- Understanding Mezzanine Financing in Real Estate: Balancing Risk and Reward for Optimal Investment

- Understanding NPV in Real Estate: Calculating Profitability and Making Informed Investment Decisions

- Understanding Preferred Equity: Balancing Risk and Reward in Your Investment Portfolio

- Understanding Real Estate Limited Partnerships (RELPs): Benefits, Structure, and Investment Potentia

- Understanding Recapture Clauses in Commercial Leases: Benefits and Implementation Strategies

- Understanding Rent Ceilings: Balancing Affordability and Landlord Interests in Housing Policy

- Understanding the 2% Rule in Real Estate Investing: Maximizing Profitability and Cash Flow

- Unlocking Opportunities: A Deep Dive into Real Estate Crowdfunding Introduction

- Unlocking the Potential of Infill Real Estate: Strategies for Sustainable Urban Development

- Unlocking the Potential of Shadow Space: Strategies for Maximizing Real Estate Profitability

- Unveiling the Economic Titan: The Role of Commercial Real Estate

- We are negotiating Commercial Real Estate Deals: Techniques and tips for effective negotiation.

- What Is a Balloon Payment on a Commercial Loan

- What Is a Power Center in Real Estate?

- What Is Impact Investing in Commercial Real Estate

- Working from home May Adapt to Office Real Estate